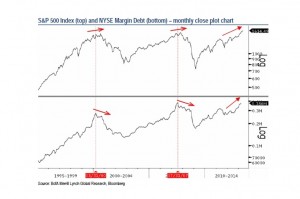

Amateur investors jump into the stock market at the price peak; and they jump in with leverage (debt).

This chart shows that stock margin debt reaches a peak just before the stock market falls +20%.

So what is some of the “Smart Money” doing? Billionaire investor George Soros just spent $1.25 billion in put options on the S&P 500 index (which profits from a decline in price). George Soros made over a billion betting against the British pound, another billion betting against the Australian dollar, and more recently, another billion betting against the Japanese yen. He is now betting that the U.S. stock market is going to fall while the small average investor is borrowing money to jump into the market. On which side is your money?