When someone’s income goes to zero, only then do they fully realize how critical it was to have emergency savings beforehand. When your income goes to zero, this is the moment a fuse has been lit on an unsustainable spending bomb. While you’re searching for new employment, it is important to determine exactly how long you have before your spending bomb goes off. Below is a template to help you determine how long you have before your bank and savings account hits zero.

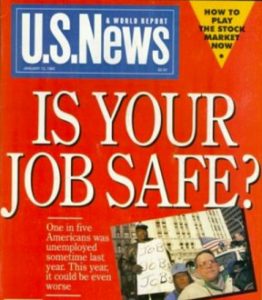

My first assignment out of college was determining how many people, per department, needed to be laid off to restructure a business for a lower-level of sales. Unexpected layoffs like this is why it is important to have enough money saved to pay for your expenses – for the length of time it takes to find a new job, in your profession, in your geographic area. This could be 3 months to 12 months, depending upon your local economy and personal skills.

The first step is to determine your current monthly fixed expenses:

- Housing: rent or mortgage, association dues, and insurance

- Utilities: electric, gas, water, trash, cellphones, internet

- Health Insurance: a new plan (or Cobra) for your family

- Food, (not dining out in restaurants)

- Transportation: vehicle payment, insurance, gasoline

Add up these necessary expenses, cut back on them where you can, and you have your monthly minimum budget that you’ll have to fund from your savings until you gain new employment. How much savings do you have? Divide that amount by your monthly minimum and this calculated number reveals how many months that you can financially survive without new income. You may qualify for state unemployment benefits or severance pay – so this is a credit to add back to your monthly expenses. This helps extend your savings, but this normally doesn’t add more than some weeks or months to your available money.

As you’re getting closer to your financial cliff of unsustainability, then it is time for very uncomfortable decisions. Now is the time to severely downsize your living situation while you still have the funds to do so. Delaying this painful decision is not an option. Many people delay taking action by putting their head in the sand and hoping for a miracle. The result is that they’re forced to rack up credit card balances and 401(k) loans. Then their cars are repossessed and their home is foreclosed upon – and they lose all the equity they had built up in all of them. Even if you get a new job after a few more months, you may be buried in unsustainable debts and still have to declare bankruptcy anyway.

Everyone’s situation is different, but your savings determines how long you can support your monthly expenses, and what you may have to do when you’re close to running out of money. Give yourself a long runway to find a new job by setting building up a savings account that is at least 6 months of your expenses.