Everyone says money doesn’t make you happy – so why do financial planners push it so much? That is easy to answer: sooner or later, something will occur for which you’ll have a critical need for money. And if you haven’t saved for this expense, there will likely be some unpleasant or expensive consequences. Let’s go through a few common ones:

- A relationship can be challenging, being broke can break it.

- Losing your job can be tough, being broke makes it a crisis.

- Your car breaking down is inconvenient, being broke makes you immobile.

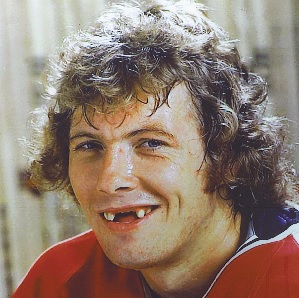

- Needing some dental work can be painful, being broke makes you toothless.

- An illness is a bad break, being broke prolongs it or allows it to worsen.

- Having children can be expensive, being broke reduces their opportunity.

- Sometimes family members need financial assistance, being broke means you cannot help.

- Losing a loved-one is a tragedy, being broke can make it more difficult.

- Having a talent or aptitude is a blessing, being broke may prevent you from expressing it.

- Most people want to retire at some point, being broke makes that nearly impossible.

- Getting accepted to a great university is fantastic, being broke may mean you’ll have to turn them down for a cheaper school.

- Having a business idea is great, being broke may mean watching others profit from it.

- Needing money is stressful, being broke means you may have to borrow it and become poorer.

- Requiring a nursing home is disappointing, being broke means your only option is the worst state-run institutions.

Whatever your situation, having savings set aside is the best source of funds for:

- Necessary maintenance

- Repairs

- Opportunity

- Financial support

- Or for any unexpected event that requires money

Whenever something adverse occurs, being broke makes it worse. Having extra money may not make you any happier, but having some savings can solve your financial problems.