Newly minted financial advisers eagerly talk about earning 10-12% or more on your money. Many of these claims are made using stock market bottoms and tops to skew the results. For example, these unusually high returns they reference will be either start around 1932 (after the crash) or 1984 (just before the stock market soared).

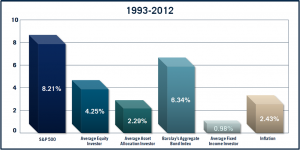

If you want some realistic numbers, look at the bar chart. Sure, the stock market has earned 8% over the last 20 years, however, during this same period the average investor earned only a measly 1-4%. There has been much research over why actual individual investors earn so little (emotional buying and selling, trying to time the market cycles, paying high fees to mutual funds and 401(k) plans, high tax rates, etc.), but for whatever reason, this is the reality. So you cannot rely on 8% returns unless you are capable enough to actually earn 8% returns. Do you track how well you are earning each quarter or year? Many of your investment goals are depending on this number, like buying a home, funding a degree, or retiring early. Make sure your plans are based on reality and not rainbows & unicorns sold by financial advisers.