Exactly like Aesop’s fable, The Tortoise and the Hare, billionaire stock investor, Warren Buffett, says, “The stock market is a device for transferring money from the impatient to the patient.” Understand that this same concept applies to all kinds of industries, activities, and transactions. Naturally, this also includes personal financial planning.

How far into the future do you manage your personal cash flow?

A day, a week, a month, a year, 5 years, 10 years, a lifetime, several generations?

The shorter the time frame for your decisions, the more money you are giving to others who operate on a longer time frame. Let’s examine your spending habits:

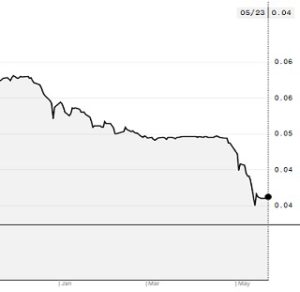

- Do you wait and watch prices to buy and sell assets at the best time?

The patient will wait for prices to bottom before they purchase and wait for prices peak in order to sell. The impatient lose money by purchasing and selling without concern over the price movement. (There are many more examples of this: the patient buy items off season, the impatient at peak season).

- Do you borrow money to buy personal items?

The patient will wait to save the money for an item before they purchase it. The impatient will pay interest charges and other fees to take possession immediately.

- Are you too impatient to set long-term career goals and map out the steps to achieve them?

The patient set career goals and do the work to make them happen. The impatient do not set any goals and find themselves in the exact same career spot 10 years later, or flitting from job to job, never advancing.

- Are you too impatient to set financial goals and plan out how to achieve them?

The patient routinely adds to savings and investments, and increases their financial knowledge. The impatient spend all of their money now and are shocked to learn that many of their income peers have a far greater net worth.

Here are two very recent examples that highlight different time-frame thinking. I was talking to a lease-renewal agent for rental homes. She said that, “Although a renter may remain for many years, they consider a 1-year lease an eternity and a 2-year lease is unfathomable. Not surprisingly, the property owners think in 10-year increments.” In another example, a teenage acquaintance buys some consumable items for just $26 on eBay. She re-sells them on Amazon for double the price she paid. How? She buys a large quantity and re-sells them in a smaller quantity. She has repeat buyers that could have bought the larger quantity at a lower price, but for whatever reason, they do not do it.

While most public companies look out 3-18 months for making decisions, visionaries perform better. For example, Jeff Bezos, the founder of Amazon (the largest retailer in the world today), doesn’t care about the next 5 years – he’s focused on the next 50 years. As a result, local retailers are struggling while Bezos’ personal net worth just passed $140 billion.

The longer your decision-making viewpoint, the more options you have for making better financial decisions. The masses are mostly about instant gratification and they struggle financially. It is my best advice that you evaluate the long-term for all of your important decisions, because all of them are also financial decisions as well.