- A high school course

- Popular finance author

- Your parents

- Online blogs

- Somewhere else

Since few high schools and colleges teach much about money management and investing, how have you ever been exposed to a systematic plan for making financial decisions? Sadly, many people cobble together a few ideas and muddle along in financial struggle their whole lives. I also come across high-income earners with no idea how to manage their money so they get themselves into more serious financial troubles. Extra money doesn’t cure bad financial habits, it exacerbates them.

Like anything, some people have an aptitude and interest in financial planning while many don’t want to be bothered. Either way, it is like brushing your teeth: It is a task that you must routinely perform or face painful and expensive consequences.

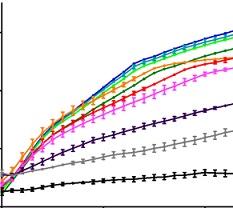

Start your financial literacy effort in small steps, and then continue to improve upon it. As much as I know about money and investing, I still pay to learn new methods and approaches to determine if it is something that I want to incorporate into my money management practice. Beware: Although, money management theories and practices are free all over the internet, sometimes you get what you pay for. Was it a short article written by a general freelance writer or a thorough report written by a business millionaire, professor, or financial educator?

How might you know if you have an adequate level of financial literacy?

- Are your financial goals on track?

- Are your debts shrinking or growing?

- Do your investment accounts have positive returns?

- Can you afford the maintenance and upkeep of the items that you own?

- Are you setting aside money for large expected purchases?

The more difficult it is for you to positively answer these questions, the more likely you need to add a little more to your financial literacy.