Whether you elect to collect social security early (age 62) or late (age 70) will result in a difference of a few hundred thousand dollars over the remainder of your lifetime. Nearly 50% of retirees count on social security for at least 90% of their income, so this is a very big decision. In my opinion, this financial decision should only be made with expert advice because there are too many variables and rules to consider in making the best choice.

There are several factors your adviser will need to know:

- Your health and likely longevity

- Marital status, along with their age, health, and expected social security benefits

- Are you working and how long are you planning on continuing to work

- Do you have other savings and sources of income

If you’re looking into advisors, beware that all of them are not equally qualified to assist you. Ask them up front if their plans include elements such as “provisional income rules,” “restricted application strategies,” and the “Tax Torpedo” (where your required mandatory IRA distributions force you into higher tax brackets on your social security income). There is such a maze of rules that software is commonly used to come up with the best customized decision for you and your spouse.

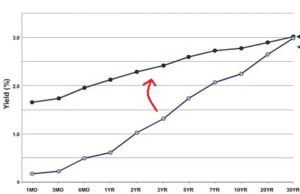

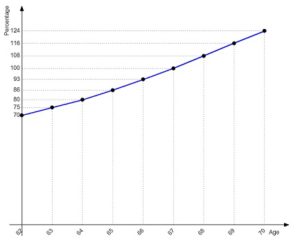

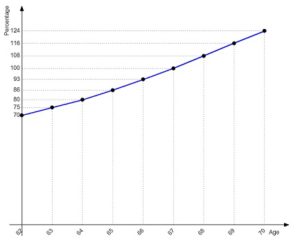

If you decide on your own when to collect social security, as most people do, the above chart shows the percentage of your full retirement benefits that you’ll receive, based upon age. So collecting at the earliest age, 62, you’ll start at 70% of your full-retirement benefits. Each year, your benefits increase 8% per year until age 70 when you’ll receive 124% of your full-retirement benefits. Some people evaluate their choice based upon breakeven dates. For example, if you wait until age 67 to receive benefits, you’ll break even on waiting for higher benefits if you live to age 78. If you wait until age 70 to receive benefits, then you’ll break even on waiting for higher benefits by age 82.

I find that people that need the income the most will file immediately, locking themselves into the lowest income level, and later regret it. (Today, the average retiree will live to age 85 and 20 years is a long time for prices to rise against you). Meanwhile, the people that are strategic wait several years to receive a far higher social security payment. I’ve also observed that if someone sadly passes away in their mid-60s then everyone around them files as early as possible, “because you never know.”

To anyone considering retirement, I highly recommend getting a full financial planning proposal from a professional. There are many federal and state rules, regulations, and scenarios that must be considered for calculations for electing social security benefits, let alone integrating it with the rest of your financial plan. You can do this on your own, but it is an undertaking to become proficient, thorough, and up to date before making some irreversible decisions.