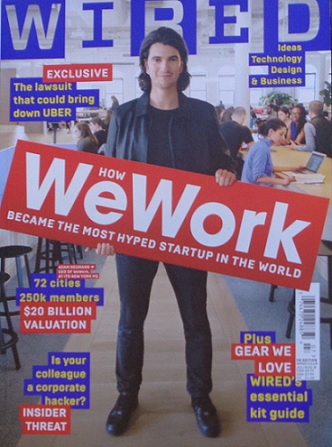

How wary should you be with Wall Street and new business models without sustainability? The shared workspace company, WeWork, was moments away from an initial public offering (IPO) valued at an unbelievably large $50 billion when it all quickly vaporized. Just a few weeks later and the company is worth less than 10% of that, and will certainly go bankrupt before December if it isn’t bailed out by former investors (like their largest investor, Softbank). It was finally revealed that there were staggering operating losses and the founder, Adam Neumann, had a rats-nest of personal siphons to the business (unethical conflicts of interest), plus he contractually obligated the company to IPO through loan covenants. A long line of top investment banks (lead personally by JP Morgan’s CEO, Jamie Dimon) were all set to sting the public and pension funds with this quagmire of certain bankruptcy, while raking in a few billion for themselves.

WeWork sought to build a business around shared office rentals from freelancers, business incubators, co-working and home-worker office arrangements. Instead of owning the buildings, WeWork was gambling with long-term leases while their own customers had very short-term leases. This is a business 101 mistake of mismatching the timing of your liabilities and assets. In addition, WeWork was competing with the building’s owners, who have far lower costs. This is partly why WeWork was losing so much money in a spectacular economy. Business writer Dan Alpert wrote, “WeWork’s entire business model seems to be a prank. Their business is taking on unhedged risk that no one sober would make.”

After filing for their IPO on August 14th, investors finally got a look at their financials, hidden among the New Age hyperbole, and discovered:

- For each of the last 3 years, their losses nearly equaled their revenue (For example, in 2018 they had $1.8 billion in revenue but lost $1.6 billion)

- The founder, Adam Neumann, would purchase properties and rent them back to WeWork

- Neumann trademarked the word “We” and sold it to the company for $6 million

- Neumann’s wife setup a money-losing training business for the company called WeGrow

- Millions were loaned to Neumann and top executives, and subsequently forgiven

- The founder cashed out over $700 million in equity just ahead of the IPO, a blaring red alarm!

- Neumann setup his stock shares to have 20X the votes of regular shareholders

- The company had a dozen HR officials quit in just a couple of years, blaming the toxic culture from Neumann. Some complaints include: non-stop emergency-meetings and chaos, lavish parties, chanting slogans to music, all-nighter business retreats with sex-capades, and promised bonuses that were never paid

- Within hours of the document release, the company was being openly mocked, competitors began preparing to take over their leases after WeWork defaults on them, and employees were looking for an exit and getting the company name off their resume’.

As investors mulled these problems, in early September the company considered cutting the IPO valuation by 50% to prevent more investors from souring on the company. Instead, they first made a quick succession of company changes:

- Neumann’s wife, the Chief Brand Officer, was let go and removed from the board of directors, her right to name a CEO successor was removed, and her WeGrow was closed

- A new female board member was hired to turn around the company culture where there was an increasing number of sexual harassment claims by former employees

- Neumann returned the $6 million he ‘stole’ for the “We” trademark

- Neumann would resign as CEO but he would still remain Chairman of the Board

- Neumann’s share’s voting rights were reduced to 10X votes per share

- Neumann claimed he would pay back profits from real estate deals he ‘stole’ from the company

- Neumann agreed to a tiny limit on the amount of stock he can sell after the IPO

With this, the company was hoping they could IPO with a lower valuation of just $10 billion. But none of those governance changes did anything to convince any investors that the company could ever become profitable. So the IPO became unviable and was postponed indefinitely – just a few hours after Neumann recorded his video for the investor roadshow. At that announcement, some of WeWork’s bonds dropped to 7% of their par value and their credit rating plummeted two levels. Then a WSJ reporter detailed how Neumann is a big pothead and drinker, he and his wife fire employees on the slightest whim, there was wasn’t any cyber security for tenants’ data, plus 20 of Neumann’s family and friends were on the payroll for doing nothing.

In desperation for cash, WeWork is trying to sell Neumann’s G650 Gulfstream private jet for $60 million and several acquisitions the company made (but they are all money losers).

Some of this has shades of another “almost IPO” which nearly occurred back in 2015 that turned out to be a scam by a fraudster. This was the infamous Elizabeth Holmes’ company called Theranos. A silicon-valley biotech company built upon lies and valued at $9 billion until a WSJ reporter actually tried to verify Holmes’ claims about what the company was up to. It turns out, they were all false claims and Holmes’ best skill was getting soft interviews and being put on magazine covers. She was a great liar and surrounded herself with people that simply wouldn’t question her (those few that did were fired and sharply reminded of non-disclosure documents they had signed).

Everybody wants to invest in the next “disruptor” company started by someone young and hip (Apple, Facebook, Tesla, Amazon, etc.). That is fine, but remember: investors were just about to pay billions to buy the WeWork IPO – which would have gone to zero. Until you get financial statements that have been audited by an outside independent company (which was the mechanism that revealed and imploded both Theranos and WeWork), then you have no idea if what you’re buying is a polished diamond or a rotting fish.

Wait, what’s that? Another company is already trying to copy WeWork’s business model. In San Francisco, Selene Cruz raised a couple million in seed money to start a “shared retail space for tiny startups,” called Re:store. There are promotions that, “It will be a totally brand new disruptive model making a Store Front as a Service, like WeWork for retail businesses.” Maybe it will succeed, but I think that model has been around a while: like farmer’s markets, flea markets, shopping malls, kiosks, and stores with individual-company products like Sharper Image and Brookstone. I recommend avoiding gambles on “new” business models and leave that to the venture capitalists to sort out.