Housing is one of your largest expenses, so it is important to have your mortgage paid off before any expected date of retirement. This dramatically increases your financial stability to enter retirement and reduce the odds that you may have to go back to work for additional income.

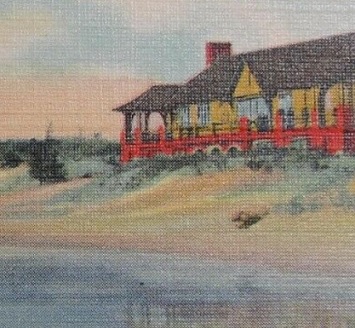

I first learned about using a rental property for retirement housing in a magazine article. A couple wanted to retire on the beach overlooking the ocean. While they both lived and worked a state away from the ocean, it was their retirement dream. They formulated a plan in their late 30s: buy their retirement home today with a relatively small down payment, and then rent it out to pay off the mortgage over time. Their goal was not investment profit, but targeting the accelerated pay down on this beach-front mortgage. Once the mortgage was paid off for this house, the couple had more financial flexibility for their retirement housing. First, as planned, they could move into the beach house when they retire. They would be able to do so comfortably because they would also have the proceeds from selling their current home (hopefully, by this time, the home has no mortgage or a small balance). Second, if their retirement location plans changed, they could sell the beach house to financially support whatever their new retirement plans may be.

I now know a few couples that are or have already employed this retirement-housing strategy for where they want to live when they retire. We did this ourselves by accident: not with a spectacular vacation house, but a rental property with a 30-year mortgage that was paid off in 18 years. This rental home is in a town with a very low cost-of-living. So in the worst financial case, we can always move into this home after the month-to-month lease ends with the current tenants. Without any mortgage, we could move in and have a very affordable housing expense that is just $106/month (for both property taxes and insurance). For a comparison, this is cheaper than any 10’ X 10’ storage unit rental in my current city! This is the power of employing both leverage and inflation over time, using them to your advantage instead of being victimized by inflation.

Using rental platforms like AirBnB and VRBO, it has never been easier to get this strategy up and running as a landlord. You can use a normal property management company or manage it yourself. All that is needed is some rental education and a reserve fund for maintenance and repairs. I recently acquired another rental for just $28,000. If you are going for your beach/mountain access for retirement, you can also use this home for some weekend vacations yourself each year (the tax law changes on this, be sure you are using the current rules).

For your retirement, you can cover one of your largest expenses – housing – for far less money by allowing renters to pay off a mortgage for you.