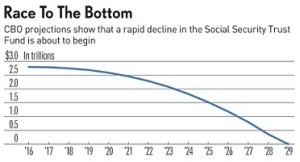

The U.S. social security system is a trust fund for retirees once they reach an eligible age. Since its inception, the program has been expanded to cover additional people who do not pay in (such as spouses, ex-spouses, children, and others). This expansion of recipients, combined with unfavorable demographics, and the entire program has become financially unsustainable. The Social Security Administration periodically projects when it will become insolvent. Just 25 years ago, the insolvency date was way past 2070. But every 5 or 10 years, this insolvency date is moved earlier than expected with their latest projected insolvency date being as soon as 2029. That is just 13 years from now.

Along with projections of insolvency, there are groups and famous economists claiming the opposite, that social security will never face decline. The only small adjustment that needs to be made is to remove the income cap so high earners will pay social security tax on all of their income, and in addition, reduce the payout to high earners, then the program will be fine. It is my opinion that these optimistic theories are incorrect, they haven’t examined the arithmetic.

In 2010, social security started paying out more in benefits than is was taking in, part of the coming demographic of a surge of retiring Baby-Boomers. The trust’s assets receive interest income, but in 2015, it was no longer enough to cover net payments and the trust had its first reduction in value, $3 billion in 2015. But this loss of value wasn’t expected to occur for several more years. Every projection of insolvency moves closer in time, not further out in time. This is because the Social Security Administration, like all government forecasts, use impossibly unrealistic outlooks of economic growth and employment that never come to pass.

All of the surpluses that social security accrued for decades will be gone by 2029. Unless benefits are reduced by 29%, the only option is to borrow more money or print more money. Neither of these options are sustainable for long periods. The federal government has already begun reducing social security benefits. They do this by artificially reducing the cost-of-living adjustment that is made once a year. The government takes the inflation rate, then removes any item with high inflation, replaces any item with medium inflation, and so only low or no-inflation items remain. One of the reasons that the official inflation data are manipulated is so that there are small annual payment increases for a host of government payments and debts, including anyone on social security.

My best advice is to not be lulled into a false sense of security – that you’ll be receiving your full-expected social security payment. Provide your own retirement funding through saving and investing so that you don’t have to worry about whether social security benefits will be reduced.