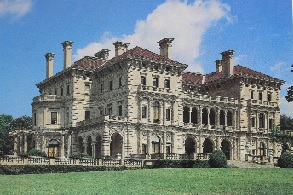

Cornelius Vanderbilt started a steamboat business and went on to create a railroad empire, making him one of the wealthiest Americans in history. One of his sons then increased the family wealth to over $300 billion in today’s-dollar terms. Within four generations, all of that family money was long gone. According to Roy Williams of the Williams Group, “60% of family wealth is spent by the first generation and 90% of the time it is all gone by the time the 3rd generation passes away.”

Even when a modest-sized inheritance is being passed to the next generation, setting up structures is important to maintain or maximize any financial transfer. There are hard structures, such as life insurance and trusts, and soft structures such as passing along financial education and family values that produced and maintained the wealth. Plus, there are tactics, such as a “stretch-IRA” to keep the funds growing tax-free as long as possible, avoiding the expense and mess of probate court, transparency and collaboration among heirs to avoid lawsuits, and a long list of others depending on your state and particular circumstances.

I have been witness to many estates unnecessarily consumed by taxes, legal squabbles, or even left inaccessible from probate or a lack of paperwork. Some people think “their heirs will do the right thing,” but when there is no Will, it is out of their hands, the probate court decides alone. The next worse estate planning is to only have a Will. Again, a Will is an instruction only for the probate court, the estate-planning goal is to totally avoid probate court. Like any important process, estate planning needs ongoing professional-level management to make certain assets are transferred to the correct people and entities, and that transfer is quick with the least amount of tax liabilities.

The next step in transferring assets is the most difficult because it requires ongoing discipline. And that is: to never spend the principal amount of any inheritance, only part of the after-tax earnings. By spending only part of the after-tax earnings, you are allowing the principal amount of money to grow larger. Which in turn will generate more investment income for you. No matter how modest the amount of money may be, its earnings could allow you to raise your spending for the rest of your life, and to your heirs as well. However, if you ever spend any of the principal amount, it is gone forevermore. Again, I have been witness to many inheritances that were vaporized upon being received by heirs, from $1,800 to very large sums of money. After the inheritance is gone, sooner or later, the only feeling that remains is regret about blowing the money. Do yourself a favor and set any unexpected or inherited money into an investment account where the principal balance is never spent for any reason.