In the 2008 financial crisis of too much debt, the Federal Reserve acted by:

- Lowering interest rates to near zero

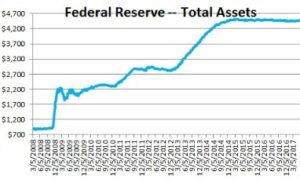

- Buying $4.5 trillion in loans and bonds, putting money into the economy

Lower interest rates made debt easier to service and pushing so much money in the economy re-inflated the stock market and real estate price bubbles over the last decade.

This week, the Federal Reserve announced that they are changing course and will start reducing their balance sheet. Starting next month, they will sell $10 billion a month, increasing each quarter until it is $50 billion a month. This is a reduction in the money supply of the banking system, the fuel of the economy.

At the same time as the Federal Reserve is effectively withdrawing money from the banking system, the U.S. Treasury wants to add another $600 billion to their Rainy-Day Fund, which will withdraw even more money from the money supply.

What does this mean?

There will be less money for primary treasury dealers so there will be less demand for all kinds of securities: stocks, bonds, and U.S treasury securities. Yes, sovereign wealth funds and other central banks are buying U.S. securities, but the combination of the Fed and Treasury is a withdrawal of $1.3 trillion from the U.S. banking system by 2020. That is going to show up in lower prices, sooner or later.

Don’t be the last person to realize the music has stopped and your portfolio is down by 40%. The stock and bond markets are still strong today, so consider is selling some off each month and then leaving that money in cash. There is no way that anyone can time a stock & market top. However, to reduce your risk, I’d offer a vague target of reducing your stocks, bonds, and mutual funds so that in 6 months, at least 50% of your portfolio is in cash.