A co-worker read an article Monday about 3D printing and bought shares of one of the industry leaders. Then he called me to ask what I thought about that stock. I replied, “I’d sell it immediately. It is trading at 2-times what it is worth and trending down, I’m afraid the big run-up was 2 years ago.”

It is fine with me if he wants to speculate with a small and affordable amount of risk capital. But having traded for a long time, I see the phases that new stock traders go through over and over. I went through these myself and most traders do as well.

Beginner Stage: buy a stock in the news that you hope might go up but instead you ride it a long-way down for a loss. Financial results are overall losses in spite of a couple lucky winners.

Novice Stage: buy stocks but continually get scared out of your trades so you never ride them up, leaving you with many tiny losses and tiny gains. Financial results are just treading water after a lot of work.

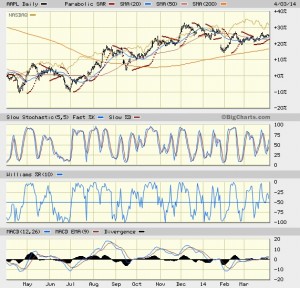

Intermediate Stage: your computer screen has two dozen conflicting indicators and chart patterns, but your stock trades have a price target and a stop-loss exit. Financial results are slightly profitable overall but very erratic.

Advanced Stage: you use very few indicators, scale out of positions, thoughtful position sizing, diversify your types of trades, and have a positive expectancy. Financial results are profitable and relatively consistent.

If some of these vocabulary terms are new to you, then you may want to get acquainted with them before you make more stock trades.

Many people discover that they really don’t enjoy the process of stock trading. At this point they either become a dividend investor, buy-and-hold index investor, or outsource the work to investment newsletters or financial advisors. Outsourcing to others can be fine but first you must get an audited track record. Whether it is a newsletter or advisor, most of them lose money for clients. Therefore, you must locate and perform some type of due diligence before you put a single penny of your hard-won money to risk on their ideas.