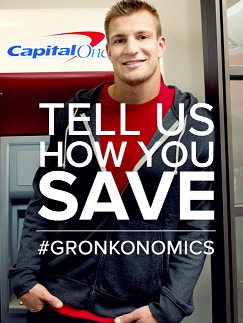

Rob Grownkowski, a tight-end for the New England Patriots, just won his third Super Bowl ring a few days ago. Unlike other pro-athletes that are bankrupt 2-3 years after their career ends, Gronkowski hasn’t spent a single penny of his NFL salary from his 8 years in the league. He even banked 100% of his original signing bonus. Instead, Gronkowski just lives on money that he makes in endorsement income. He has now teamed up with Capital One to offer tips on his “Gronkonomics,” challenging people to save money.

His other tips:

- No designer clothes, he wears old clothes until they are rags

- No outrageously expensive jewelry, homes, or big-ticket luxury items (although he has splurged on a few cars recently – only from endorsement earnings)

- If I do spend extra money, it is usually on charity through my foundation

FinnApp estimates Rob Gronkowski’s net worth at $153 million, far more than anyone would expect from his annual salary. He currently has a base salary of $5.25 million and it can go up to $10.75 million, depending on how much time he plays and how well he does.

Comedian Jay Leno has a similar financial habit. “When I first started out as a kid and an unknown comic, I’ve always had 2 incomes – one to bank and one to spend, and I only spent the smaller one. I made money at a car dealership and from comic gigs.” At the peak of his career, when he was making $30 million a year from NBC’s Tonight Show, he still never touched it; Leno only spent the money he made from comedy shows on the side. “So I made sure that I had at least 150 comedy shows a year, to make certain I never touched a dime of the Tonight Show money. So many entertainers blow all their money but savings gives me peace of mind. If my career ended right now, financially I’ll be fine.” Jay Leno is 68-years-old and still performs comedy gigs plus he has a TV show, Jay Leno’s Garage that is 4 years old. Jay Leno’s net worth is estimated to be $400 million.

You do not have to be a high-income celebrity to employ this 2-income tactic, all you need is a second income source:

- I know several couples that bank one salary while the other salary is used for living expenses.

- A family acquaintance is single and while he has a job, he would spend weekends working a multi-level marketing program with cleaning products. He kept it up until that side income paid two times his salary, then he saved 100% of his salary while only spending the MLM income.

- A relative’s second income is flipping real estate. She and her husband both work (and have 2 children) and they buy a cheap fixer-upper to live in while they make repairs to it on weekends. After 2 years (to maximize the IRS tax-exemption), they would sell the home and roll all of their equity into their next larger fixer-upper. They repeated this again and again, into more expensive homes, and worked their way up to multi-million dollar fixer-uppers for very large capital gains.

Of course, you can save a portion of one income, it doesn’t have to be 50-50 – but consider it a target: having two incomes and saving one of them for your maximum financial stability.