The Dow Jones Industrial Average and S&P 500 have both made new price highs. Hurray, we’re saved! The “wealth effect” will increase consumer confidence, people will start spending money and the economy will improve.

The Dow Jones Industrial Average and S&P 500 have both made new price highs. Hurray, we’re saved! The “wealth effect” will increase consumer confidence, people will start spending money and the economy will improve.

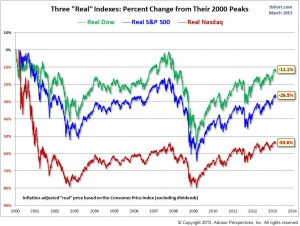

But if you look at a price chart that has been adjusted for inflation, courtesy of AdvisorPerspectives.com, you’ll notice that all of the 3 major stock indexes are still below their price high of 2000 and 2007. Now this isn’t actual inflation but the government issued CPI, true inflation is of course higher.

What does this mean? It means that the strength of the U.S. stock market is fake. It is a mirage created by U.S. Federal Reserve’s actions to make the U.S. dollar worth less through inflation or money printing. Since inflation is eroding the value of the currency, the prices of assets and investments are getting more expensive. The price of a share of stock, a barrel of oil, a home, or anything else is becoming more expensive when priced in a currency that is losing value, the U.S. dollar.

For you to financially tread water, your income and assets must first overcome inflation. For example, if inflation is 3% per year and your salary raise was only 2% then you’ve lost 1% in purchasing power. So even though you received a 2% raise in nominal terms, you are 1% poorer in inflation-adjusted terms. Understanding the compounding effect of inflation is an important element in your financial literacy.