A colleague’s son is four years out of college and now has $5,300 in a new stock brokerage account. Like many kids under age 30, he has followed the herd into every problematic financial fad, such as: buying $100 in bitcoin at its peak only to watch it fall by 80%; lost $425 on a bad-credit peer-to-peer loan; opened an $250 Robinhood brokerage account (with hidden fees) to buy a weed stock after it had already tripled; and now he wants to put all of his money into Tesla shares.

Anytime a casual and uninformed investor thinks something is a good idea, it is highly likely to be a very bad idea that destroys your hard-earned money instead.

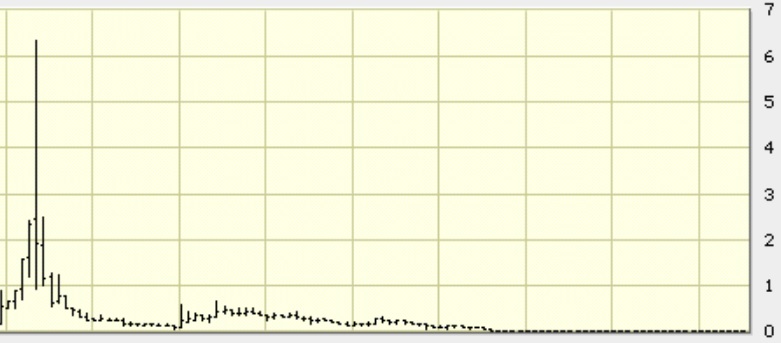

A prudent portfolio should have a mix of investments, starting at the base with the most stable investments. These could be FDIC insured savings accounts, bank CDs, or U.S. Treasury Bills. These are locations that only go up in value with interest payments. Your portfolio will not be stable if it can be wiped out with an average-sized stock market downturn, some financial volatility, or a single investment going to zero. Only after you have this durable financial base do you consider adding a next layer that may have some small risk, such as a short-term bond with a high credit rating. Layer by layer, your portfolio is a pyramid with much of your money in stable or very-low risk assets. An imprudent portfolio is jumping straight into a single stock (let alone Tesla, a company that has never earned a penny from business operations and relies heavily upon fickle government subsidies).

Until you have saved up a meaningful amount of money, say $50,000, you do not have enough capital to make a reckless gamble with a small amount of, say $500. A recent finance Phd. concept in investing is called “Core and Satellite.” This refers to having a core portfolio of a few stock and bond index funds and maybe a couple tiny satellites which are individual speculations. The bulk of your money is prudently invested while only a small percentage is allocated to higher risk opportunities. However, if your speculative plays are generally unprofitable, then it is best to just run with a core portfolio.

There is a favorite story told by a commodity futures broker. A new potential client asked a broker if trading futures was appropriate for him. The broker responded, “Well, take the garbage disposal test. Withdraw $5,000 out of your bank account in cash. Think about how hard you worked for that money, what you missed out on to save that money, and finally how long it took you to save up that $5,000. Now, bring that cash to your kitchen garbage disposal, stuff the money in and shred it as it goes down the drain. If you and your wife are totally Ok and at ease with that, then yes, you have the capital and temperament for the volatility and risk of losing all of your money by trading a small account of commodity futures.” The same could be said of cryptocurrencies, penny stocks, option trading, and more.

If this young man had put his money into a simple savings account, he would probably have over twice the amount of money that he has right now. So before you run out and put all your money into the latest stock fad at a price peak, establish a base of stable income producing investments and then a simple core investment portfolio.