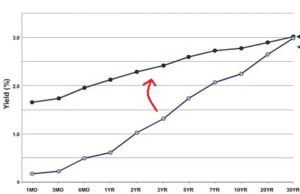

The yield curve is a plot of bond fixed-interest returns over time. The near term rates from bonds are generally lower than longer-term rates, so the chart’s curve slopes up to the right. This shape of this bond-yield curve is normal. However, the curve points fluctuate every day and sometimes the yield curve is flat or even temporarily inverted.

As you can see in the chart, now is one of those times when the yield curve is flattening. Historically, a flattening yield curve indicates that the bond markets are expecting a recession in 6 months. All of the financial publications are now writing about a possible recession from this signal. Many times, this is true; but it my opinion, not as likely this time.

Today, there are forces creating the inverted yield curve that have nothing to do with the underlying U.S. economy. First, the U.S. economy is booming across most industries: transportation, manufacturing, and services are having their best growth in 14 years while unemployment is at a 17-year low. So the economy is performing well, so why the inverted yield curve?

The U.S. Federal Reserve is raising short-term interest rates, the near point on the chart. However, slow economies and low inflation in Europe and Japan have interest rates near zero. As long as their interest rates remain so low, higher interest rates in the U.S. will be attractive to investors around the world, keeping longer-term yields low as well.

Yes, there are currency moves and currency hedging to consider. But as long as U.S. rates remain far above European and Japanese rates, then investment funds and central banks will continue to purchase longer-dated U.S. bonds. In my opinion, Central Banker maneuvers around the world is what is causing gyrations in the U.S. yield curve and they are not impacted by any potential recession coming soon.

(Wall Street has two ridiculous funds for trading the yield curve. There is one to profit from a steepening yield curve (ticker symbol STPP) and another one to profit from a flattening yield curve (ticker symbol FLAT). While the yield curve has been flattening for the last 2 years, had you invested in FLAT you would have lost 6% of your money. As mentioned in the blog post from 3 weeks ago, be very wary of Wall Street gimmicks).