After 2008, the U.S. Federal Reserve lowered short-term interest rates to zero; responding to the largest U.S. banks becoming insolvent during the financial crisis. Over 10 years later and interest rates still haven’t moved up much. Meanwhile, some interest rates are negative in Europe as they continue efforts to stimulate their economy as well. Unfortunately, maintaining artificially low interest rates for so long is causing problems; such as individuals and institutions are forced to gamble on high-risk assets to meet their investment return objectives. Some of the unintended consequences of prolonged low interest include:

- Pension funds have doubled their allocations to riskier stocks, private equity, and hedge funds.

- Insurance companies have had to raise premiums and lower annuity returns.

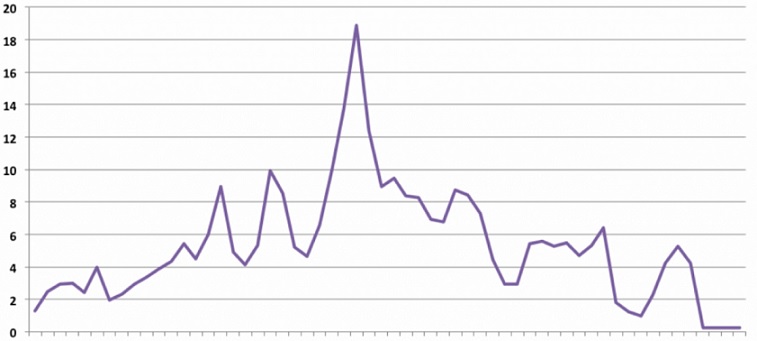

- Retirees have not been able to get decent yields on bank CDs, so they have migrated into dangerous junk bonds and lower-credit preferred stocks. CD rates fell by over 80% from 2007 to 2010, so anyone relying upon normal rates has suffered greatly (a wealth transfer from savers to banks).

- Both the bond and stock markets have been pumped up to over-valued levels – greatly increasing everyone’s risk in them. Not everyone has been invested in them for the ride up, but everyone would be impacted by their downfall.

- Trillions in derivative financial instruments cannot be accurately priced with negative interest rates.

- As low as rates have been in the U.S., they are high compared to Europe and Japan, so money has been flowing into the U.S. stock market and real estate, creating asset price bubbles.

- Another side-effect has been that all government debt became artificially cheap, pushing back their day-of-reckoning for cutting spending and addressing large liabilities.

- Inflation-adjusted yields this low have historically only occurred during periods of war, reflecting an autocratic repression of free-market interest rates.

These unintended consequences will continue for U.S., Canada, Europe, and Japan until interest rates return to a normal level without Central Bank interference. In the meantime, do not be lured into gambling with risky investments or imprudent behavior to reach for a slightly higher yield. This will place you into a very precarious financial position if there is an adverse market move, creating potentially catastrophic losses.