When a central bank imposes negative interest rates on the banking system, the theory is that it makes banks more willing to lend money and bank accounts become less desirable as a location for money. A negative interest rate is actually a tax and everyone avoids taxes, if they are able. The central bank hopes that the tax will prompt people to spend money instead of holding or saving it in a bank. While this may occur, it also prompts other activities, unintended consequences, which counter the central bank’s goal of stimulating the economy with new spending.

Just a few unintended consequences that I can think of include:

- Banks become disintermediated in the economy as people close accounts, use more cash for transactions instead of credit cards, and seek alternatives to bank accounts to store their money. Again, even this is problematic because the U.S. is a $17 trillion economy with only $850 billion in actual paper currency. The financial system is an upside-down pyramid resting on a tiny portion of actual cash, the rest is digital. If everyone went to the bank to withdraw their money, few people could walk away with cash. When this recently happened in Argentina, Greece, Cyprus, and others, people panic and hoard cash. Again, this is the opposite of the intention of negative interest rates. To reduce or eliminate cash transactions today, many countries are also imposing low limits on allowable cash transactions (France €1,000; Spain €2,500; Italy €1,000; Uruguay $5,000; Greece still limits how much cash you can withdraw from a bank; Denmark, Sweden, and Israel want to phase-out cash altogether; U.S. banks report cash transactions over $5,000 to regulators; Chase Bank now prohibits cash in their Safe Deposit Boxes).

- If the flight from bank accounts grows large enough, then this would erode banks’ capital, forcing them to sell loans to increase their capital reserve balance. This could stress the banking system, similar to how the subprime loan crisis began in 2008.

- Where will money land that is withdrawn from the banking system? In my opinion, it will likely go to the same place where excess liquidity has gone since 2008: the U.S. stock market, U.S. real estate, and for the wealthy, expensive trophy collectibles. These three are likely in price bubbles already and these bubbles would be exacerbated by negative interest rates.

- Retirement plans are ruined. When bonds and savings accounts pay closer to 0% instead of 6%, you have to save a whole lot more money to grow your retirement balances up to their target level. So people are forced to save more instead of spend more to spur the economy. When safe and stable investments pay next to nothing, it also forces everyone to become a speculator in order to earn any return on their money. Speculating is a difficult business for professionals, let alone amateurs. I predict that mass speculation is unlikely to turn out well for retirement account balances.

- Aside from the U.S. dollar, the world’s reserve currency, many currencies have been debased by various forms of quantitative easing. These currencies become more impaired the more negative that interest rates become. There is a risk that the U.S. dollar will also become an impaired currency as well; as printing money and borrowing more money has been unable to stimulate its weak economy since 2008.

- Negative interest rates are also likely to create two other inversions. First, the interest-rate yield curve, which normally slopes upward further out in time, may flatten or invert so investors will avoid long-term bonds. The second is commodity contango, referring to the spot price is normally lower than the futures price and this may flip into backwardation, where the futures price is abnormally lower than the spot price. This could create many usual effects, one of which is that commodity ETF’s would likely have automatic losses and move down even though the spot price of their commodity hasn’t moved.

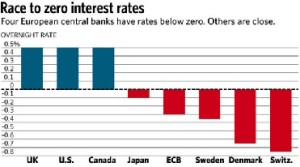

Today, around 20% of the world’s economies have negative interest rates. Canada and other countries in economic struggle are considering joining them. The U.S. has held interest rates near zero for 8 years to jump-start its economy, but that has not worked. So it is likely that negative interest rates could be tried in the U.S. as well. As proof, the Federal Reserve’s latest stress test guidelines in January 2016 included for the first time: negative yields on short-term U.S. Treasuries.

If negative interest rates are introduced by the U.S. Federal Reserve, then my best advice is to consider:

- Holding a few months of expenses worth of cash outside of the banking system. It is better to be early and prepared than late on a short-term run on cash.

- Be nimble with stock market and real estate investments. While these assets will move up in price initially, be ready to exit or at least hedge if they begin a sustained fall.

- If financial assets get into trouble simultaneously (the U.S. dollar, stocks, and bonds), then consider placing some money into hard assets such as precious metals to offset the decline in paper assets.