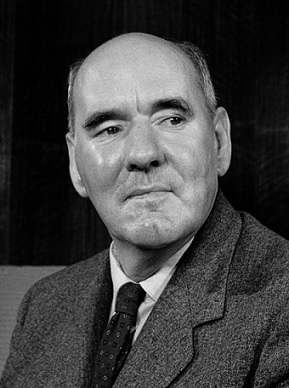

Cyril Parkinson wrote an essay in The Economist magazine published in 1955. Included is his First Law that, “Work expands to fill the time available for its completion.” As you can imagine, this concept can be applied to numerous behavioral traits, which includes all aspects of managing money. Parkinson’s Second Law states, “Expenditure rises to meet income.” The remedy for all types of Parkinson’s Law applications is the exact same: you must set your own internal limits. Exert your willpower, creativity, and planning to set and enforce your own personal limits. In the case of money, this means that without your own limits you will likely find yourself spending all of your income, leaving nothing for maintenance, repairs, or replacements, let alone emergency savings to investments.

You have likely heard a few of these self-imposed money rules before:

- Save 10% of your income

- Save 50% of any salary increase

- Save 100% of any inheritance or unexpected money

- Purchase only used cars

These rules may be appropriate to your situation, or maybe not, but you must discover, create, and refine some of your own personal money rules and limits. Otherwise, you may end up like the average person that falls into the rut of Parkinson’s Law with scant savings, no retirement assets, and unnecessary financial struggle.