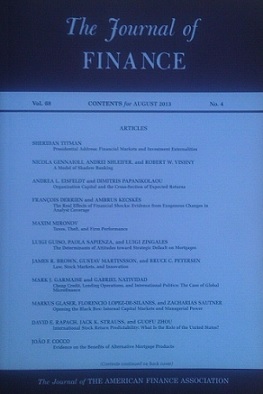

If you owned a small laundry mat, you’d probably subscribe to all kinds of industry publications. This way, you’d keep up with: technology changes, trends, risks, best practices, new income sources, and more. Reading these would simply be a prudent business practice. For many people, their retirement accounts are among their largest assets and yet, very few read the trade journals to have any idea what is going on. I am not referring to fluffy retail magazines but the publications that industry professionals read – such as finance journals and financial planning publications. A few things I learned from reading these this week.

1. Betterment.com is offering a 2.69% savings account to lure new accounts with FDIC insurance. (I opened one myself to earn more on savings).

2. Target Date funds may not work as planned, even though this is the MOST commonly selected fund for 401(k) plans. Research is indicating that stock equity exposure should be a U-curve over time, instead of constantly decreasing. The low-point of the ‘U’ is the date of your retirement.

3. The U.S. Department of Labor wants to allow the worst financial product into 401(k) plans: annuities. Annuities are the most overpriced, complicated, and problematic investment product that, in my opinion, are suitable for almost nobody. Yet, the U.S. Congress is considering exposing more savers to the insurance wolves. No surprise that the congressman who introduced the bill has received huge donations from insurance companies and Fidelity Investments.

The investing landscape is always changing, and some fairly important news items (like those above), are available but very few people make themselves are aware of them. Managing your money is an unavoidable and tiny part-time job for everyone: so how are you allocating your investment time each month?