As you are saving and investing money, a frequent concern people have is “Am I on track for retirement?” The more reference points you have about growing your investments, the more feedback you have regarding whether you’re saving enough for retirement. Better to learn now when you can do something about it before it is too late and retirement is imminent.

There are many studies regarding investable assets and net worth by age, the numbers below are from the Transamerica Center for Retirement Studies.

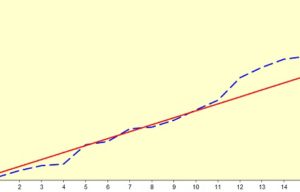

In your 20s, the average retirement savings is $16,000. It is likely that there are some financial struggles during your 20s: your income is relatively low and entertainment expenses are relatively high, and student loans are prevalent. However, now is the time to build the regular habit of making additions to your retirement savings every single time you earn money.

In your 30s, the average retirement savings is $45,000, but your savings balance should be 1 times your gross annual salary.

In your 40s, the average retirement savings is $63,000, but your savings balance should be 3 times your gross annual salary.

In your 50s, the average retirement savings is $117,000, but your savings balance should be 4.5 times your gross annual salary.

By age 60, the average retirement savings is $172,000, but your savings balance should be 6 times your annual gross salary.

Even if your retirement savings is not making these thresholds, it is important to keep them in mind so that you are continually make new additions to your accounts.