When you want to protect and conserve your investment money, then you place it in secure vehicles like FDIC insured accounts and AAA credit rating instruments like bonds. The return on your money will be low on these investments but its purpose is not high growth but protecting what you have. These are also easy investments to find and totally passive to manage, there is nothing for you to do and they require no financial education.

However, to acquire and buildup any meaningful amount of money it cannot occur in places like those. Compound interest at safe but low rates cannot add up to much on small amounts of money. It is physically impossible unless you have many, many decades. In order to earn a sizeable amount of money you must earn a 20% return on your money, or more. Money that earns 20% or more will compound into a very meaningful amount of money each year that you allow the gains to continue to grow.

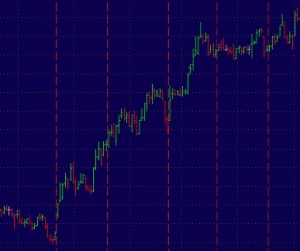

The problem is that there are no easy, off-the-shelf investments that will hand you a return this high. It will take more education, time, and effort to find, acquire, manage, and exit investments with this level of return. Here are some investing examples that I have done to reach this target return: rental real estate, raising livestock, stock trading, and selling home-made items. I’m sure everyone will have a different list of investing candidates of what may be appropriate for their talent and capability. I met someone that earns well over 20% on weekends by buying and selling used motorcycle parts; any interest you may have will likely have some avenue for you to earn a meaningful return.

When you are in the “accumulation phase” of your investing life, you must find 20% returns to build your portfolio into a meaningful amount of money. Once you are retired and are in the “distribution phase” of your investing life, then you want to have more of your money in locations where it is conserved and protected; but unfortunately earnings will be significantly lower. But that’s OK because what is most important during the distribution phase is to actually have some money to withdraw and spend when you are least able to earn more.