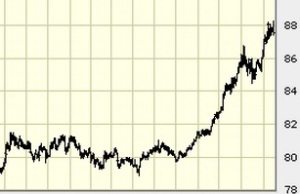

The U.S. dollar has been rising for the last 3 months. When the dollar is rising this frequently pushes down certain commodity prices, like oil and gold, along with currencies like the Japanese Yen and European Euro.

So what are the investing implications for you? There are many but let’s look at a few stock possibilities:

- When gasoline is cheaper, it benefits the poor the most, so they have more money to spend at dollar stores and auto parts stores.

- When gasoline is cheaper then airlines, trucking, and chemical companies become more profitable.

- When gold is cheaper, gold jewelers make more sales.

- When the Yen and Euro are cheaper, wealthy foreign investors buy U.S. real estate to maintain their purchasing power in New York City, Miami, and San Francisco.

- When the dollar is strengthening, U.S. treasury bond interest rates fall.

- There will be less tourism to the U.S.

Anytime there is a market trend or reversal, there are macro-economic shifts that create potential profits and losses. Being aware of these shifts allows you to sidestep some predictable losses and position yourself for investing gains. Once you conclude that a particular industry may benefit from a new trend, then you can begin to narrow down a candidate list of industry stocks to the top two in which you may want to invest.