Any location for money has risk. Even cash under your mattress is at risk for theft, flood, fire, or devaluation. Any location outside of your control adds additional risks and costs. Bank accounts are more risky these days with: bank bail-ins, IRS seizures without a warrant, and an inadequately funded FDIC insurance.

When there is high inflation, money melts in value like ice on a hot summer day. So you spend it or transfer it as quickly as possible to maintain your purchasing power. The higher inflation goes, the more worthless the currency becomes and the average person becomes more motivated to exchange it into an alternative currency. Once the inflation rate goes above 25%, exchanging your currency becomes a part-time job for everyone.

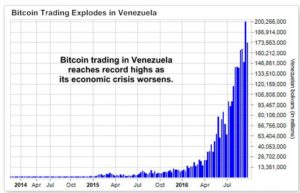

In countries experiencing high inflation, residents exchange their weak currency for the largest nearby stable currency; the Euro, the U.S. dollar, the Chinese Yuan, etc. When Zimbabwe’s currency imploded a few years ago, many store owners only accepted gold for payment. Venezuela’s currency has collapsed and as the chart indicates, an unusual currency is skyrocketing in use: Bitcoin. The more the government tries to control an economy, the greater the side-effects become, such as a worthless currency. Residents are forced into black markets and alternative currencies to store their money.

Several large hedge funds and billionaire investors are buying more gold as they expect paper currencies to fall in value; all of the major currencies together – with no safe haven. The latest is Lord Jacob Rothschild, who is also the Chairman of CIT Capital Partners. In his recent letter to shareholders, Rothschild stated that they are reducing their position in U.S. dollars for gold and other currencies.

Some of the smart money is diversifying away from the U.S. dollar. Although the U.S. hasn’t experienced moderate inflation since the early 1980s, it is common for a mismanaged economy to experience high inflation. The U.S. Federal Reserve has certainly been reckless with the U.S. dollar over the last 8 years, printing trillions in extra currency. Do you have any plan to protect your U.S. dollars from deflation or inflation?