On December 31, 2019, Iranian military attacked the U.S. embassy in Bagdad. Three days later, a U.S. drone strike killed the planner, General Qassem Soleimani, who the U.S. claims was plotting another imminent attack. While most people are interested in the politics of the events, money managers have a professional duty to react, professional traders are looking for profitable trades, and retail investors many want to protect their portfolio.

What positions did these investors and traders examine and consider?

- France and Germany moved into Iran right after President Obama’s nuclear weapons development deal in 2015. So shorting French oil companies (or the French stock market) while buying U.S. oil companies is a pair-trade worth considering, and would already be showing profit.

- The military/defense ETF ticker symbol “ITA” holds several major military and aerospace companies. Many investors bought this ETF (which has gone up 3% in the last two trading days). Or, you could hedge this trade by also shorting the S&P 500 Index, on the expectation that the defense stocks would outperform the overall stock market.

- Some investors were just concerned with protecting their portfolio, buying February put options on the S&P 500 Index as insurance. Since puts are somewhat expensive, instead, some bought a vertical debit spread to lower their cost and risk for this hedge.

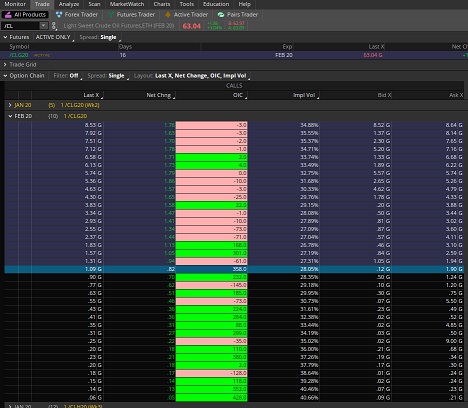

- Crude oil jumped up from $61/bbl by nearly $3 because Iran is a large oil exporter. Once the price backed off $1, some investors opened a short-term butterfly trade to profit from the spike up in volatility pricing for the crude oil options on futures.

- Another portfolio protection trade is to purchase gold. Gold has also been up about 1.5% in the last 2 trading days. (To execute this quickly, you can buy ticker symbol “GLD” with one click).

- Today, the option volatility for oil is higher than gold, which is in turn higher than the stock market. So there is an opportunity for a combination trade of selling oil options and hedging with buying either gold or S&P 500 options.

I’m sure there are many more ways to have traded this news event (did natural gas keep up? or will the Chinese/Indian stock market be hurt – the two largest buyers of Iranian oil? Will Tesla got a boost as a non-gasoline alternative vehicle). Having a plan to protect your portfolio at any moment is something you should always have ready. But depending upon the news of the day, there are opportunities to profit for those willing to evaluate and immediately place trades before the opportunity disappears.