Anytime there is a systemic drag on your investments, the cumulative costs that add up are staggering over decades. In the case of 401(k) plans, you may not be aware that there is a 2-3% expense each year that erodes your account balance. Compound this 2-3% for 20 years and the average account 401(k) holder has 71% LESS profit than someone investing outside of a 401(k) plan.

The extra expense that most 401(k) plans incur is from the difference between mutual funds and ETFs, exchange traded funds. For example, if you open a brokerage account, you could place money into a S&P 500 stock index mutual fund or into an S&P 500 stock index ETF that trades like an individual stock. When you add the expenses and tax consequences, the extra cost of the mutual fund over an identical ETF is 2% (according to researcher and fund manager Mabene Faber) or 3.17% (according to Forbes magazine). Most 401(k) plans only permit mutual funds to be purchased, the funds with the extra 2-3% annual expense eroding your account balance.

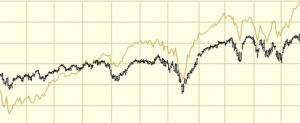

The expense gap between mutual funds and ETFs becomes staggering over longer periods of time. For example, using identical portfolios:

- In 20 years, the mutual fund balance would be 21.5% smaller than the ETF balance.

- In 30 years, the mutual fund balance would be 32.7% smaller than the ETF balance.

- In 40 years, the mutual fund balance would be 43.0% smaller than the ETF balance.

Why are you continuing to put your money into 401(k)s that needlessly chews up your money?

Let me show you a real example. I was asked by someone to look at their 401(k) account in which they had $167,000. They contributed a little over $500 per month and their employer matched with $250 per month. So the employee was adding $6,000 per year and their employer was adding an additional $3,000. Now, let’s look at the extra expense of 2-3.17% in mutual fund fees and taxes each year. At $167,000, 2% is $3,340 lost to the broker. So on one hand the employer is putting $3,000 into the account but the brokerage firm is taking at least $3,340 out of the account each year – for a net loss of $340 per year. (At 3.17%, the brokerage loss is a staggering $5,300 per year to fees and extra taxes).

Yes, there are other issues to consider with 401(k) plans like the size of matching contributions, tax deferral, the quality and type of funds that are available, etc. But every analysis that I have done for others on their specific 401(k) plan points to it being a money losing-location for your money compared to placing it into an IRA or Roth IRA.