James Cordier and his partner Michael Gross trade commodity options for clients at OptionSellers.com.

They were so good at attracting clients that their minimum deposit to join ramped up to $1 million and accredited investor status (an SEC rule that you must earn $200K/year salary, or have $1 million in investments to put money into risky investments). Cordier had been interviewed several times on TV as an options expert, and wrote a best seller on Amazon, The Complete Guide to Option Selling.

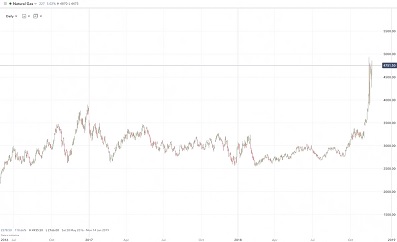

A few weeks ago in mid-November, natural gas futures went against Cordier’s position and he not only lost every penny of their investment, but they had to write an additional check to the clearing exchange, creating an even larger loss for investors. Around 300 clients lost an estimated $150 million in a few hours on a market move that wasn’t that big. What in the world happened? Cordier sold options on commodities without any hedge or risk minimization strategies. When the natural gas market moved upward against his short calls (plus a losing position in crude oil), he was trading such large positions for the account size that he vaporized the entire fund, and then some, before his clearing house threw in the towel and closed his positions to stop the bleeding. One former investor Tweeted that he had lost 130% of his original investment with Cordier.

Cordier then sent out an apology video to his clients. Sadly, he mostly rambled about how losing everyone else’s money will affect him personally (and his opulent lifestyle), nothing about his clients’ situation. His analogy, “There was a rogue wave and I wasn’t able to steer clear of it and it capsized our boat.” This is untrue. It would be more accurate to say, “I steered the boat directly toward a minor wave (to sell high-implied volatility in the options) and then I loaded down our boat with so many positions that the first drop of water that might spill on the deck would have sunk any battleship. Sorry that I made every single beginner-mistake in the book with your hard-earned money.”

Was it really a “rogue wave?” It couldn’t be – 5 months earlier, James Cordier wrote a magazine article about natural gas’s high volatility. The financial industry all know that naked short selling on natural gas a “widow-maker.” Cordier’s apology video is so cringe-worthy that there are a few parody videos on YouTube about it. Exactly like the Chairman of Enron was busy with the interior carpet color of his new jet while investors were being decimated, Cordier was busy on building out a new opulent office building while his investors were losing their future.

A couple years ago, a friend of mine gave me a copy of OptionSellers’ monthly newsletter. It was several months old. In it, Cordier talked about his naked options trading method. Plus, I glanced through several of his commodity forecasts and they were horrifically wrong. I immediately threw it in the trash where this ultra-high risk gambling belonged. I have no problem with naked option selling for a speck of your account value – if you manage the position delta. But Cordier did the opposite of those two prudent actions and then borrowed money to amplify trading gains and losses.

The only question now is if Cordier acted contrary to his operating agreement or as a fiduciary that constitutes criminal behavior. Needless to say, law firms have already begun rounding up his former clients claiming: exorbitant fees, inappropriate strategies, negligence, plus (even more insane) trading with leveraged margin. It is hard to believe the firm lasted as long as it did.

Maybe Cordier could pull a “Jon Corzine.” Former NJ Governor, Jon Corzine, stole $1.2 billion of clients’ money to avoid margin calls on his failed trades and illegal accounting. He avoided any prosecution, let alone well-deserved decades in prison, by hiring Eric Holder’s law firm, while Holder was the U.S. Attorney General. And then magically, all of the federal investigations into his criminal wrongdoing and theft were terminated.

In my opinion, Cordier’s fund detonation reinforces a hard-won investing alert:

Does the investment fund manager, investing newsletter, trading course, signal service, or investing whatever – market mostly or solely to beginners?

That is a 3-alarm red alert in my view! There is a reason that very few or no professional investors placed money with Bernie Madoff, James Cordier, or any of the other big blowouts. This is because they examined the investing method, or the manager, and gave a “hard no” on placing a penny with them.

You can’t be skeptical enough before you hand money to someone else to manage; particularly if they are making promises that no one else can. If you don’t understand their method, find someone who does or skip this one. If you can’t get any details about their track record or method, skip this one. A colleague told me last night, “I have a high-traffic bank and the manager told me they still turn away 1 person/day who believes the scam that a Nigerian Prince is going to give them $20 million if they would send him $1,500 in cash up front.”