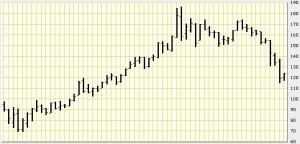

The price of gold has fallen 30% in the last two years; this is after rising 600% over ten years.

Where will gold go from here? One market phenomenon is that the demand for paper gold (ETF’s, futures, options, certificates, and other derivatives) has plummeted while the demand for physical gold (coins and bullion) has been skyrocketing.

In countries where their currency has been wiped out (Asia, S. Europe, Latin America, etc.) there are long lines to enter shops selling a dwindling supply of physical gold. In countries with no experience with a sudden currency devaluation (U.S., Canada, Britain, France, etc.), for the average person, physical gold is simply old jewelry that you pawn for money.

This week, something new has happened, the price of gold futures has changed from upward sloping to downward sloping. Meaning the price of gold today is worth more than the futures price of gold a few months from now. (In economic terms, the price of gold has changed from contango to backwardation.) This is not supposed to happen for gold and is normally arbitraged away. For this to be maintained for gold means that there is insufficient supplies of gold so investors, banks, speculators, gold producers and users, are willing to pay more for gold today than take the risk that they won’t be able to access some in a few months.

This downward slope of futures prices for gold has only occurred 4 times in the last 14 years and each time it signaled a medium-term low in the price of gold. So, today may be a good price to buy gold before its next upward move.