European junk bonds now yield 2.77%. Yes, the worst-rated bond trash in Europe has a yield that is only a speck higher than the U.S. government 10-year treasury bonds, considered among the safest investments in the world, at 2.33%.

So how can the best and worst bonds have nearly identical yields??

If you were a European bond manager, you have a puzzle to solve. Central Banks are buying all of the sovereign bonds and much of the corporate bonds, pushing yields on them negative. So there is only one place left to get any positive yield (theoretically at least) and that is corporate junk bonds. These are bonds highly likely to default, they are non-investment grade (meaning fiduciaries cannot buy them), and their yield is so tiny, a portfolio of them is a guaranteed loss. Buying these bonds is an exact fit for the Wall Street risk/reward saying, “like picking up pennies in front of a steamroller.”

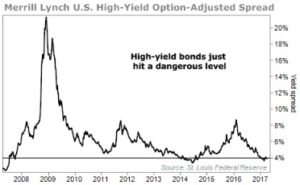

Negative interest-rates are imperiling pension funds, insurance companies, and other institutions who must purchase bonds. Even though junk bonds in the U.S. are very low (3.9%), U.S. companies are now racing to sell their junk bonds in Europe because their rates are so much lower. These bonds are nick-named “Reverse Yankee Bonds” in the industry but in my opinion, they are a failures looking for a sucker.

What all of this points to is: colossal systemic risk in the European bond market. When this bubble pops, there will be tears for any investors with European bond exposure.