Are you prepared for the next economic recession? Can you remember what a recession is?

Looking back a few thousand years, economies and industries move in cycles, seasons, waves – never in a straight line. Psychologists have a term to describe the failure of people to imagine or prepare for a scenario that they haven’t recently experienced: normalcy bias. This is a dangerous trait to apply to your finances because everything economic moves in waves: interest rates, currency rates, commodity prices, unemployment, and the overall economy. The most successful people are those that anticipate, prepare, and are ready to act in advance of economic moves that others do not expect.

When there is a recession, short-term interest rates go up, unemployment goes up, and people spend less because they are unsure of their jobs. These ripple throughout the economy: raises are smaller or non-existent, overtime disappears, layoffs are common, and repossessions by lenders increase because people cannot make payments. Your personal finances must include the possibility of a recession. If you’re living paycheck-to-paycheck when one hits, your lifestyle may be imperiled with a single hiccup in your income.

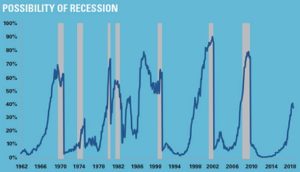

The average time between recessions in the U.S. is 6 years. However, since the 2008 financial crises, the economy has been growing so slowly that the economy never over-heated (which can turn into a recession). This slowest-ever expansion is now the longest on record. When will the next recession arrive? There are a few recession predictors: federal government tax receipts fall, short-term interest rates rise, new home sales shrinking, falling real estate values, train and shipping cargo shrinking, loan default rate increasing, business inventories increasing, and many more.

What are these recession predictors indicating today? Many of them are pointing to recession. By being aware of economic cycles of expansion and contraction, demographic changes, and anticipating these changes, you can be prepared for these changes instead of getting hit in the chin when they materialize.