From households to banks to countries, nothing is more predictable than a financial calamity resulting from mismatching assets and liabilities. In order to be sustainable, a debt needs to match the asset that supports it: the maturity date, currency, credit rating, etc. Every few years some country or central bank gets blown out because they selected an easy short-term solution, only to go bust because of an obvious mismatch. Mismatching is a roll of the dice: sometimes you win. But when you lose at the country level – residents pays heavily for decades to come.

For example, U.S. President Bill Clinton moved long-term U.S. debt into short-term debt to save a percent in interest and make his annual budget number look good. Never mind that he financially imperiled the country to get favorable press for a couple days. This time it worked out, but it was still a 50-50 gamble.

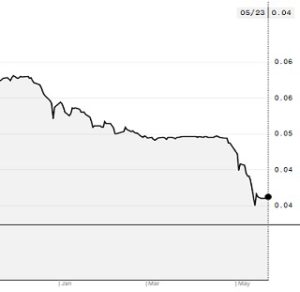

Argentina hasn’t been so lucky with their gambles and today the Argentine peso is in free fall from its latest losing gamble (as seen in the chart). When you peg your currency to the U.S. dollar, and issue a lot of debt in U.S. dollars – how are you going to afford it when the U.S. dollar strengthens against your home currency? You can’t. That is what Argentina’s socialist government failed to learn, yet again. Argentina cannot afford a rising debt payment – debts that were just issued this January are likely to become unaffordable. What was the term of this new debt? Oh, just 100 years. Anybody want to buy some certain-to-default debts that won’t be paid back for 100 years?

Large debts are prompting the Italian government to consider a parallel currency to the Euro. No one will lend to spendthrift Italy (just like spendthrift Greece a few years ago), so Italy is trying to create a new currency (just like Greece a few years ago) to get some liquidity. But just like Greece, the European Central Bank and International Monetary Fund (IMF) will not allow this to occur. So the poor and middle class Italians can likely look forward to becoming ground into the dirt like the European Union did to Greece just a few years ago.

Financial literacy is very important for a family but even more critical for a country. For example, the average Venezuelan adult lost 25 pounds last year from a lack of food. Not from any natural disaster, but from 15-years of increasing socialism where inflation is now around 150% per month. The Venezuelan government is still taking no action to reverse the downward spiral of their economy or currency. This is why holding your money in gold or bitcoin is commonly banned in countries with a continually weakening currency. Government-issued capital controls slows down the currency collapse by erecting a prison that keeps money from escaping toward stronger currencies and assets. It is unfortunate that financial literacy appears to be rare for both families and countries.