There have been hundreds of concepts of money over the last 5,000 years. Since the internet was popularized around 1993, there have been many failed digital currencies (look up Flooz that was promoted by Hollywood celebrities). New crypto currencies were supposed to be Gold 2.0 by solving all the problems related to failed digital currencies: limited supply (they must be mathematically mined), they are transparent (through the blockchain), and are peer-to-peer with no intermediary.

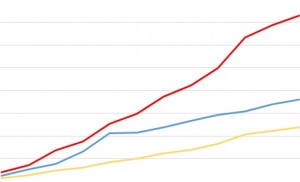

One cryto-currency shot up in value in 2013: Bitcoin. It rose from a value of $150 to $1,100 in a single month before it fell back in price. This popularity started an explosion in competing cryto-currencies, crypto-exchanges, and other digital products and services around them. Retailers jumped into accepting Bitcoins and everyday economists and financial advisers are asked, “What do you think of Bitcoin?”

Let’s review some key risks and benefits:

1. There is no intrinsic value underlying crypto-currencies – a specific mathematical number has no worth. So unlike gold or silver, cryptos require “faith and belief” in their value, just like the paper currencies of dollars, pesos, euros, and yen.

2. The blockchain of transparency has not prevented theft by hackers and there is no recourse to get your stolen “money” back (because there are Bitcoin money launderers just like cash launderers of illegal transactions).

3. There is personal benefit of temporarily using crypto-currencies to bypass currency controls and societal benefit to having a currency out of the hands of politicians that have a 100% track record of destroying it.

Right now, crypto-currencies are a new industry in flux. Many new cryptos are “pump & dump” currencies to defraud buyers while others are improvements upon deficiencies in older cryptos. Many cryptos are being hoarded because buyers are hoping that they will rise in value – they are being created and held for speculation, not for transactions. This indicates that cryptos are not yet money, but a gamble on a volatile price. Many cryptographers argue over which direction the industry should move to become more acceptable. Since this industry is quickly changing, it may be unrecognizable a year from now. If you want to get involved with these you’ll have to learn a new language around hash-rates, blockchains, mining methodologies, e-wallets, payment-gateways, the changing laws and regulations, along with possible user acceptance of cryptos.

However, it is my recommendation that current crypto-currencies are not yet a vehicle for money, a trusted store of value.