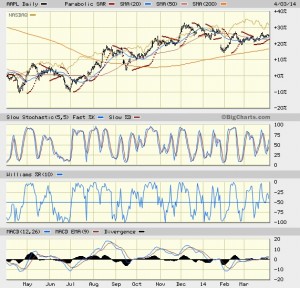

The U.S. stock market frequently falls by 10%. While this drop is not a big problem for a long-term investor, the stock market also periodically falls by 25-50% or more, which is a huge problem. When the U.S. stock market drops by a large amount, the stock markets in other countries can fall even further like Britain, France, Russia, and Brazil. Instead of riding these stock market declines to the bottom, side-stepping these large drops over +15% will substantially boost the value of your investment accounts over time. Riding down a severe stock market drop of 25-50% can make the difference between being able or unable to retire as planned.

Below are a couple ways to protect your portfolio:

1. Most 401(k)s have no hedging options and so selling your stock funds to avoid larger losses is the only tactic to protect your investments. When a broad stock market index like the S&P 500 falls from a price high by 14%, you could, for example, sell half of your stocks or stock funds. When the index continues to fall and is down by 20%, sell your remaining stocks or stock funds so that you do not suffer a 25-50% loss or more in a protracted stock market decline. Then, slowly buying back into stocks at much lower prices.

2. Instead of selling your stocks or stock funds, maintain some cash on standby to purchase an inverse ETF to hedge your stocks or stock funds. ETFs are funds that trade like stocks and there are dozens that move in the opposite direction of the general stock market. For example, if you are concerned about a market drop, you can purchase an UltraShort S&P 500 with ticker symbol “SDS” to hedge your stocks and stocks funds. When the S&P 500 moves down by 1%, the SDS will move up by twice that amount or 2%. So if you have $10,000 in stocks you only need to purchase $5,000 of this hedge to neutralize a large down move in the stock market.

3. Using stock option strategies is another method to hedge your portfolio as well. This is beyond the scope of a short blog post but they are not difficult to discover and learn before the next stock market decline. Just be aware that it is routine for portfolio managers to purchase put options to hedge their portfolio for potentially negative news events or price drops and pay for these puts by selling call options (a hedging strategy called an option collar).

What I have mentioned are ideas that you need to fully understand before you consider using them. You need to understand how they trade, how much you need, and exactly why & when to enter them and exit them – a full plan before you actually employ them.

The stock market is at all-time highs from Federal Reserve money printing but this money printing is scheduled to stop before the end of 2014. This fundamental shift in the financial markets may trigger the beginning of a stock market decline. Everyone that owns stocks or stock funds needs to have some kind of plan to sidestep large losses to their portfolio at all times. I highly recommend you that you have some kind of plan, or you’ll be left riding the stock market all the way down on its next +25% drop that will certainly happen sooner or later. Losing this much of your hard-earned money will impair your net worth and dramatically lengthen the time-horizon for your investments to meet your financial goals.