When the stock market drops or becomes volatile, investors become anxious and consider ways to protect their money. One method they consider is subjectively trying to buy near price bottoms and sell near tops, called market timing. Unfortunately, all of the academic evidence points to both professionals and amateurs being very poor at timing stock market purchases and sales. This means that engaging in market timing is most likely to reduce your stock market returns by making ill-timed sales and purchases of their funds and stocks. This is the opposite of what investors are trying to achieve.

But this doesn’t stop investors from trying to use volatility to profit or minimize losses.

So what are some rules about getting into and out of the stock market that might be helpful to investors?

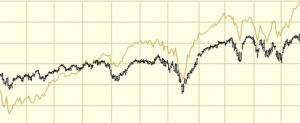

I use a rule for a portfolio that is otherwise for “Buy and Hold Investing” that I call The Emergency Brake. The rule is: Anytime the stock market falls by 15% from its most recent high point, I exit everything.

The stock market is in constant flux, this is the nature of the market. But this volatility also includes price drops of 25%, 50%, and a whole lot more. These are crushing financial losses that can take decades to recover from and many people don’t have decades to wait. Since the 1970’s, a new stock market low has been followed by a new all-time-high within 20 years. So a “Buy & Hold” investor will eventually recover, if this pattern holds in the future.

By selling everything, you are protected from any further losses beyond 15%, and many of these larger price drops do occur. By eliminating these significant losses, your portfolio value will be far higher than it would have been if you had taken no action. For example, I have details on 401(k) plans where two people would periodically ask me for advice. One of them used the Emergency Brake twice while the other one took no action. A few years later, having a side-by-side comparison, the account that side-stepped two significant drops had nearly twice the overall return as the account that rode out both drops.

Yes, there are risks of using the Emergency Brake. For example, you may sell at a 15% drop and that may be the price bottom and the stock market may rise from there. This would confirm the classic ill-timed market timing that reduces overall returns. But this emergency brake is a form of insurance and like all insurance, there is always a cost. There are more sophisticated ways to set a brake on your portfolio, such as buying an inverse ETF that matches your portfolio, but again, you need to have the money because there is always a cost to a hedge.

If you have employed the Emergency Brake, then when do you get back in? I use two rules. First, similar to the 15% fall, if the stock market rises 15% from a more recent low, then I buy back in. My second rule is more subjective, if the stock market “calms down” with much reduced volatility and trades sideways for quite a while. To me, the longer these occur, this indicates that the risk of an immediate and continued fall has subsided and I can start buying back in; hopefully at a lower price point than when I sold out.

Partial positions: there is no rule that you must be 100% fully invested or 100% out of the market. You can scale in and out with partial positions. For example, at the first 15% drop, you can sell a third of your stocks, at an additional 15% drop, you can sell another third of your stocks, etc. And the same thing to scale back into buying stocks.

Remember that academic research points to timing the stock market as a very bad idea for investors. However, if you want to protect yourself from a protracted fall in the stock market, then make sure your ideas have been evaluated in many types of market conditions over decades, or use the simple one that was just outlined. Additionally, you may adjust the 15%, by reducing this number, to say 12%, but be aware that it will be hit many more times, chewing up your account with sales and purchases. Or you can increase the 15% to 18% and have fewer trades but have a larger loss before you take evasive action. Be careful and thorough in your market-timing analysis, be consistent in your application of any rules that you make, and then follow your investment plan.