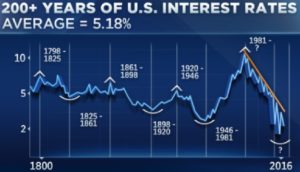

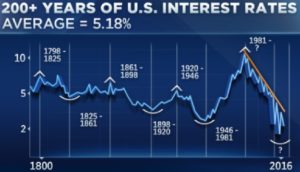

Recent financial market headlines include: “30-year bond bull market is over,” “The bottom is in for bond yields,” “London Interbank Rate Highest in 8 Years,” and “The Great Rotation from Bonds to Stocks Has Begun.” By looking at long-term charts and recent bond prices, it is possible that a 30-year run in bonds has hit its peak price, at least in the short term. As proof, bond investors are selling bonds at the fastest rate in 3 years, mortgage rates are above 4%, and many investors are expecting an interest-rate increase by the Federal Reserve next month. Looking at a 20-year price chart you can see that bond prices have a very, very long way to fall if this is a price peak. How should you react with the bonds or bond funds that you own?

Most people hold some bond mutual funds or bonds as part of their portfolio allocation in retirement accounts. There are also many securities highly correlated with bonds such as REITs, utility stocks, and others known for historically paying a decent interest rate or dividend yield.

If today marks a medium or long-term top in bond prices, there are some actions you can take to minimize downside risk. The first and easiest is to sell some or all of your bonds. But then you have another problem – deciding where to place this money instead of bonds funds?

For most casual investors, the best approach to hold bonds is to own individual bonds until they mature and are fully paid off. This way, no matter what the price gyrations do, it is irrelevant to your interest payments and final payback of your principal. Rather than research individual bonds, there are bond funds that do for you called, “Target Date Bond Funds.” There are two large sponsors of these funds, Guggenheim Bulletshares and iSharesBond. They have many offerings so you can choose among several types of bonds that will mature anywhere from 1-7 years. You can choose maturities to time your income needs, or “ladder” by purchasing bond funds that mature in a variety of time frames.

Another way to manage your bonds is to use some money to hedge them. This requires some homework. Let me briefly explain:

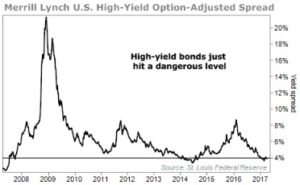

First, the bond market is a complex terrain of many types of bond issuers – U.S. Treasuries, Corporate, High-yield Junk, and many different maturity dates. There are also country specific bond funds, and today, Emerging Market Bonds are collapsing in price. You may want to sell all you have of these. Since a falling price pushes yields up, these countries will likely find it more difficult going forward to roll-over debts at more expensive rates. Another factor to consider is that when interest rates rise in a country, then that country’s currency becomes more valuable. So if the Federal Reserve raises interest rates, then the U.S. dollar will likely strengthen as well. This is yet another dimension to analyze for your investments: will a rising dollar help or hurt your specific investments?

Second, because there are so many types of bonds, your hedge needs to match your specific holdings as much as possible. There are many inverse bond ETFs that you can purchase to hedge your bonds, they move in the opposite direction of a particular class of bonds. There are over 30 of them, but the top 20 in trading volume can be found here: http://etfdb.com/etfdb-category/inverse-bonds

Third, you need to decide if you own enough bond investments for the cost of hedging. If you have less than $100,000 in bonds, it probably isn’t worth the cost to hedge. It takes money (and opportunity cost) to purchase $100,000 worth of the appropriate inverse ETF (it moves in the opposite direction of your bonds). But you don’t have to hedge all of it; you could also hedge 25%, 50%, or 75% of your holdings, depending on how much interest-rate risk you’re willing to accept. If you don’t want to learn and manage hedging, just sell your bond funds and look for something to re-invest the money in that will profit from rising interest rates. For example, an industry that performs well with rising interest rates is insurance companies. They will buy bonds paying a higher interest and have portfolio teams that manage hedging and other portfolio risks.

Whatever your level of interest in managing your money, you or your money manager must have a plan of action when the economy or financial markets change. There is growing evidence that there is a big change happening right now: the ever-lowering interest rates in the U.S. is pausing and may be starting to move the other way. How are you adjusting to this new condition – to defend yourself from losses in bonds or profiting from rising interest rates?