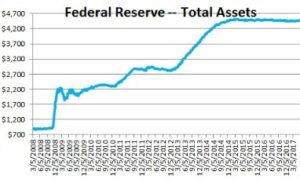

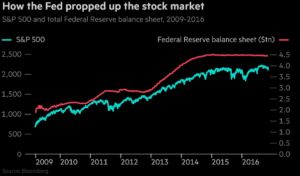

Last October, I pointed out that the U.S. Federal Reserve had announced their schedule of selling off assets every month going forward. This draws money out of the economy and the stock and bond markets would have an adverse response going forward. I advised at that time to consider reducing your exposure to stocks and bonds from rising interest rates by March 2018.

Since that post, the stock market moved up for 2 months,and then began a sideways channel with high volatility. The stock market is still in that volatile channel while interest-rate sensitive bonds have dropped some in value.

I’m no oracle; I simply followed the largest player manipulating the economy and their announcements. With the recent unfavorable stock market volatility, the Federal Reserve has hinted that their plan of raising interest rates any further will be paused for the next quarter.

For stock market timing, a reference point that I always track is: the stock market making a 15% fall from its most recent high. If you examine stock market volatility and following its price trends, then the general timing rule is to:

A) Exit or reduce stocks if the stock market falls 15% from its most recent major price high point.

B) Enter or add more when the stock market rises 15% from its most recent major price low point.

If you are timing the stock market yourself with a method similar to this, using a percentage less than 15% will have you trading too often and getting whip-sawed from normal volatility. If you use a percentage much more than 15%, then you’re taking on too much risk and riding a downturn longer than was prudent. When you exit stocks at a 15% drop, you are minimizing your losses on what could grow into a 25%-50% loss – which would be devastating to your investment goals. (Note that this 15% rule is only for a general stock market index – a particular stock or commodity may need a percentage far above or below this amount.)

Today, the most recent price high point for the S&P 500 is 2,941 on October 1st and is currently trading at 2,650 this is just a -9.4%price drop. So for right now, it is not signaling to exit all of your stock positions yet. That signal price is if the S&P 500 drops to 2,117. Of course, you are free to sell off a portion to reduce your risk in this time of volatility or anytime you’re uncomfortable with the economic outlook.