The illustration of a goat tied to a tree so it can be milked is an accurate depiction of what both governments and companies are continually attempting to do to your wallet. These entities would like to turn you into an ongoing annuity; making regular payments to them forevermore. Businesses call it “a subscription business model.” It is your financial role to minimize these from consuming your income. These ongoing costs raise your monthly fixed expenses, leaving you less money for saving, investing, and normal spending.

A necessary fixed expense may be rent, electricity, or car insurance. But beyond these basics, you can go crazy by adding a never-ending list of additional fixed expenses. Each additional fixed expense can slowly creep up and subsume far too much of your income.

Let’s go through some common fixed expenses that many people have:

- Cable TV with extra movie channels, sports packages, and on-demand movies

- Cellphone service with extra data plans, insurance, and features

- Yard fertilizer service and pest control plans

- Life insurance that is no longer needed

- Identity theft protection and credit monitoring plan

- Time share vacation package

- Monthly charges for bank accounts, financial software/apps/advisors

- Alarm system service

- Website hosting with endless feature upgrades

- Appliance maintenance plans

- Hobby clubs with monthly membership billing

- Computer backup plans, malware & virus plans

- Health club membership

- Streaming music and video subscriptions

- A themed box-of-the-month subscription: coffee, wine, candles, beef jerky, etc.

- Storage unit for items worth less that what you’ve paid in storage rent

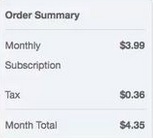

The point is: a relatively small fee of $9.95 per month may appear affordable for a service, and it may be necessary for your circumstances, but when you have many of them, they accumulate to a lot of money being vacuumed from your checking account. I was helping a friend struggling with his debts and found that he had 3 monthly recurring charges on his credit card for services that he had never used! Meanwhile, the financially-aggressive people that I know actively drive down extraneous fixed expenses. They do this so they have money available to invest or splurge on items and experiences that are most important to them.