The short answer is: it has already happened.

Over the weekend the government in Cyprus froze all bank accounts and announced that they were confiscating 10% of account balances. A little less (6%) for accounts under $100,000 and 15% for accounts over $500,000. This was part of a European Central Bank (ECB) bailout that was negotiated over the weekend. Note that the ECB wanted to confiscate 40% of account balances. Remember, these are demand deposits that were supposedly insured from losses. Public outrage ensued and it may not happen, but sooner or later, Cyprian shareholders, bondholders, and others will be left with cents-on-the-dollar to bailout their banks that gambled in Greek real estate and businesses.

A government that confiscates bank accounts is nothing new when the government has a lot of debt. Normally, you wake up to find your bank account denominated in a new currency that is worth only 10% of the old one. A common question this week is: could this happen in the U.S.?

In my view there are 3 different ways that is has already occurred and is still occurring: money is missing from your bank account when:

1. The U.S. Federal Reserve lowers interest rate longer than 18 months to stimulate the economy. I will give them the benefit of the doubt for 18 months of trying to kick-start the economy, after that, it is stealing money from savers. When short-term interest rates are artificially lowered, the higher market interest rate that you would be receiving as a saver is transferred to short-term borrowers like banks, businesses, government, and speculators. Coincidentally, this is how asset bubbles are created like the real estate bubble that burst in 2007.

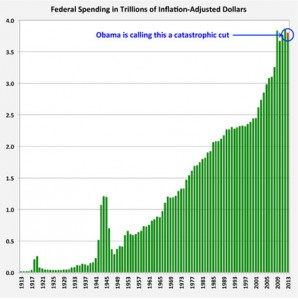

2. The U.S. Federal Reserve is spending $85 billion each month to purchase long-term government bonds. Savers and retirees that use bonds as an investment vehicle are having their market interest rate income stolen and handed to the seller of government bonds – the U.S. Federal Government. This way, the government can continue to spend an unsustainable amount of money without having to pay the true price of that borrowing. The Federal Reserve is preventing free-market price-discovery of the interest rate that those bonds need for investors to buy them.

3. The U.S. Federal Reserve has been printing trillions of dollars (through buying junk loans from banks) that is washing through the economy. This money printing has been raising the price of commodities and common goods through price inflation. You experience this every time you visit the grocery store to find 30% of the packages have shrunk in size but the price remains the same or went up.

Unfortunately my friends, your bank accounts have already been grabbed in 3 different ways by the U.S. Federal Reserve, and sadly, it won’t stop soon and the big surprise is yet to arrive. None of their 3 actions can solve the problem of bad bank loans and too much government debt, they only delay and exacerbate the problem (I view it as a game of 3-Card-Monte!).

More specifically, there are laws or bills that have been introduced to allow banks to “levy” taxes on deposits to bailout banks in Spain, New Zealand, Britain, and the U.S. As they say, “Don’t think of it as a tax, think of it as a negative interest rate!”

Aside from Cyprus stealing money from insured bank depositors and wiping out senior bank bondholders as demanded by the European Central Bank, another disturbing comment came after the final deal was closed. Jeroen Dijsselbloem, the Dutch Finance Minister who heads the Eurogroup Finance Ministers, said, “What we’ve done last night will serve as a model for future banking crises. If a bank cannot re-capitalize itself, then we are going after the shareholders, bondholder, and depositors.” Realize that this means: no money is safe around a bank – it can be frozen and taken by government whim to bail out that bank. How much money do you currently have at risk in bank deposits, bonds, or shares?

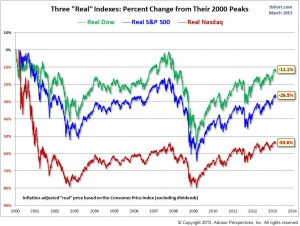

The Dow Jones Industrial Average and S&P 500 have both made new price highs. Hurray, we’re saved! The “wealth effect” will increase consumer confidence, people will start spending money and the economy will improve.

The Dow Jones Industrial Average and S&P 500 have both made new price highs. Hurray, we’re saved! The “wealth effect” will increase consumer confidence, people will start spending money and the economy will improve.