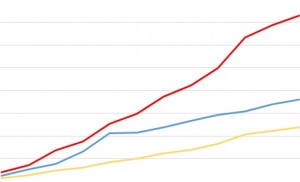

I recently reviewed an IRA account for someone who opened it with two $2,000 deposits that is now worth $100,000 today. The deposits were made 28 years ago into four large company stocks: Coca-Cola, American Express, Clorox, and Merck. A quick calculation reveals that this is just over a 12% annual return for that time period. This is an excellent return rate that any investor would be happy to earn. But I happen to know that the timing of this investment started right at a market bottom, 1984, just before both bull markets of the ‘80s and ‘90s.

I wanted to know what this portfolio would have done it had been opened at an inopportune time, such as the stock market peak of the year 2000 and been held until today. Excluding dividends, the portfolio would only be worth $5,800 for an average annual return of only 2.8%.

This example helps highlight that the difference between an opportune or inopportune time that you make a stock purchase can have a difference in your account balance by +1,000%. This is a very big deal; a return gap on your portfolio this big can create the difference between being able to retire early and never being able to retire at all. In my study of market cycles, I have determined that any lump-sum investment into stocks should be made over a 2 year period, made quarterly. For example, you just received a $5,000 bonus that you want to place into stocks. Divide the lump sum amount by 16, and these portions are used to make quarterly purchases into your stocks over the next two years. This way you are scaling in to minimize your exposure to buying everything at the peak without delaying too long to take advantage of future bull markets in stocks.