Most people are aware that they may be able to make more money by active investing to compound their money, but they immediately reject the idea. Excuses include, “I don’t have the money,” “I’m raising kids,” “I don’t have the time,“ “I don’t know anything about business,” etc. However, there are many opportunities for micro-entrepreneurship that only require the smallest amount of time, effort, money, and commitment.

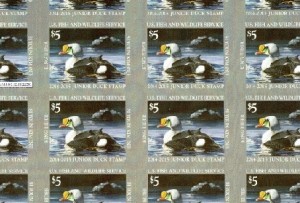

So I am going to provide a tiny business model that anyone can perform. I learned this model from someone who had been making a few hundred dollars a month for at least 7 years. After his prompting, I even did this a few times myself. This business model is about buying a sheet of stamps directly from the post office, which is in high demand, and then re-selling that sheet at a higher price on eBay. It really is that simple and can be started for less than $15.

The U.S. Post office is continually issuing limited runs of collectible stamps and there are common shortages for the designs that are most desirable to stamp enthusiasts. You’ll need a quick education about which design is rare right now. Sometimes you can find this out online or you could call your local post office to see which designs are selling out the fastest. Now that you have a high-demand design that you want to target, call nearby post offices, or online, to buy as many of these rare sheets as you can afford.

Once you have your stamp sheets, place them for sale on eBay for 20% more than your cost, or whatever markup that similar stamps that are difficult to find are selling at right now; plus shipping costs. After paying auction fees and shipping your sheets out, you should be able to net a minimum of a 10% profit within a week or two.

Granted, earning $1 on a $9.80 sheet of stamps isn’t a lot – but you have a tiny and sustainable business model that you can ramp up to become as big as you want. There are many sellers on eBay doing this right now because the market is so big.

Maybe you have no interest in stamps – that is fine. I know people who do this same tiny business plan with laptops & cellphones, used generators, motorcycle parts, ammo, LED headlights, chainsaws, watches, movie DVDs, and many others. They sell items on Craigslist, flea markets, specialized auction websites, or spend time generating a list of commercial repeat buyers. Whether this is for side-money or a primary source of income, your interests or hobbies likely have some kind of market where you can start earning money as the tiniest entrepreneur.