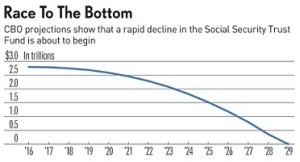

Many financial plans for retirement dangerously ignore income taxes. There are several taxes and penalties for retirees, and you need to incorporate them into your plan so you know what you can and cannot afford to do in a sustainable manner. Below are some items that you need to include in your calculations.

1. Social Security is tax-free only if your adjusted-gross income is less than $32,000 (for a joint tax return). If your adjusted gross income (joint) is between $32,000 and $44,000, then 50% of your social security income is taxed at ordinary income rates. If your adjusted-gross income (joint) is over $44,000, then you pay ordinary income tax on 85% of your social security income.

2. There is an Obamacare 3.8% sur tax for those whose adjusted-gross income is over $250,000 for someone single. This sur tax is for capital gains, selling anything for a profit. Before you say, “that doesn’t apply to my income level,” remember that your income may get some large boosts with: withdrawals from a 401(k) or IRA, or if you are selling a second home, rental property, or business interest.

3. Withdrawing money from qualified retirement accounts before age 59 ½ will result in a 10% tax penalty. Far worse is the 50% tax penalty if you fail to make a minimum required distribution from your IRA once you are age 70 ½.

4. Medicare Part B charges you an increasing amount of money, the higher your adjusted gross income may be. Medicare is deducted from your social security retirement payment. This extra-monthly tax starts at $85,000 for singles of $121.80, and maxes out at $268.00 per month for singles earning over $129,000.

All states have different tax plans that affect retirees. There are several tax-related policies you should be aware of and if they may apply to you:

- Interest and dividends taxed? Are there any limits?

- Social security retirement pay taxed?

- Pension payments taxed? Are there any limits?

- Military pay or disability pay taxed?

- Inheritance and Estate Taxes?

It is no surprise that retirees move to another state or location after they retire to reduce their tax burden. I have a retired relative who just purposely moved to a state for their no-income tax policy and it will save him nearly $40,000 every year.

A thorough retirement plan will have all of these tax elements mapped out for your particular circumstances. The alternative is to retire and discover too late that high taxes in your state or type of income is unaffordable, and then you have to go back to work. A neighbor discovered this three years after he retired. He and his wife moved to an expensive city with high property taxes, so he was forced to go back to work. Unfortunately, he is bitter about it and having difficulty with the physical demands of the job.