There are many locations where you may have money, but there are two that you should be evaluating the closest. There is one money location to minimize and the other to maximize. First, the definition of these two types of money locations: dead money and paying investments.

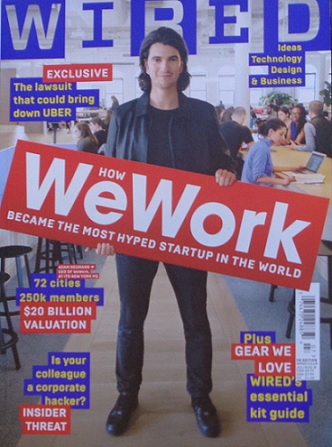

Dead money = is the label for your money that is not paying you anything. Examples include: excess emergency cash, excess money in a checking or savings account paying nearly nothing in interest, or value in items you no longer use (jewelry, ATV, unused laptop, etc.), plus equity in items that you do use, such as your home and cars.

Paying investments = provide you a monthly or quarterly return and is the most desirable type of location for your money. Examples include: dividend paying stocks, interest paying bonds, and high yield savings accounts with FDIC insurance, small business ownership paying you dividends, and real estate investments paying out distributions.

Paying investments is easy to evaluate: you can’t have enough of this and you want the investment income re-invested as much as possible while you’re accumulating assets. Paying investments is critical to growing your investment income in the most robust manner. This is the type of income that can slowly support more and more of your expenses as it grows in size. At some point you will want to retire and paying investments is the most important income to make this happen for you. Otherwise, to get spending money you are forced to sell some of your investments and reduce their principal balance which permanently reduces its future earning potential.

Dead money is more difficult to analyze. Avoiding dead money is impossible and some dead money is fine for several purposes. But in general, dead money is an expense in opportunity costs. As an example, let’s say your family has an extra car that isn’t being used, worth $5,000. If you sold the car, that $5,000 could be placed into a paying investment making you richer with each payment. These missing investment payments are your opportunity costs for leaving this dead money where it is. Not only do you have opportunity costs, the car is falling in value with time and decay. This is the same for most dead money in physical objects that are unused or no longer serve a purpose for you.

The dead money (equity) in items such as your home and vehicles needs to be evaluated against your financial capability. In general, if you are a poor money manager, then you want money out of your hands and into places like your home equity and car equity where you won’t spend it. However, if you are a skilled and knowledgeable money manager and investor, then you may want to reduce your equity in home, cars, etc. (if you can do it at a low interest rate) and instead have some of that prudently invested in paying investments at a higher rate so that you are favorably leveraged.

Dead money and paying investments are your two locations for money that are the most important for you to track and evaluate. This is because they directly impact your net worth on a monthly basis, one favorably and the other unfavorably. Your financial goal is to minimize the dead money that you have (and its corresponding opportunity costs). Recover that money to be a part of your continual additions to your paying investments.