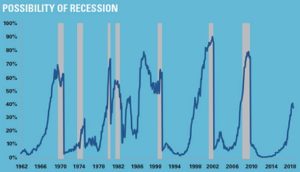

If the last 100 years is any guide, the election won’t have any immediate effect at all. There are cycles to interest rates, stock market ups and downs, recessions, and for the most part – the White House occupant is not the dominant driver in any of those. But is there anything we can predict for certain?

Who knows what he or she will actually accomplish once they are in office, but there are a few big policies they have consistently said they would work toward enacting.

Donald Trump:

- Repeal and replace Obamacare. This will likely lower the costs of medicine but also reduce the revenues of those services or products were mandated by Obamacare. If out-of-pocket medical costs are reduced for consumers, this may increase consumer spending to boost the economy.

- Enact a 45% tax tariff on Chinese imports. Since the U.S. purchases a tremendous amount of goods from China, this would increase prices for American consumers in the short-term and the long-term, as China would likely respond with their own economic retaliation.

- Cut the budgets of the Environmental Protection Agency and the Dept. of Education. If extraneous regulations are reduced, this provides economic benefits across the country.

- One potential stock candidate to buy: HCA Holdings that will benefit if Trump allows U.S. Veterans to go to any doctor to get medical treatment.

Hillary Clinton:

- Pass the Trans-Pacific Partnership trade deal. This is a special-interest smorgasbord of monopolies and relinquishing sovereignty to corporations. I’d expect these newly minted monopolies to severely reduce economic growth for the many, to benefit a few companies.

- Cut red tape and taxes on small businesses. Small businesses have not been hiring under President Obama for these very reasons, this could create a large increase in needed jobs.

- Expand Social Security and Medicare to cover more people and increase benefits for some. Since both programs are already heading toward insolvency, this will accelerate the national debt and problems for these programs.

- One potential stock candidate to buy: gun manufacturers of either Smith & Wessen or Sturm, Ruger & Co. Anytime a president pushes for gun control laws there is a surge in gun and ammo sales. Firearms manufacturers say President Obama has been the greatest salesman they’ve ever had (when he pushes for gun control), and a Hillary Clinton presidency will likely be similar.

Unless you perform an industry and company-specific comparison for their specific political policies, for most people any election shouldn’t influence your investing strategy that you are holding for the long term. For example, tax policy will be modified by Congress and the Senate and so the final result may not resemble anything that the presidential candidate was trying to accomplish. After every election, political compromises and realities dramatically temper campaign promises, so predicting anything specific, in my opinion, is probably not worth your time until it actually occurs.