GoBankingRates conducted a survey of over 5,000 people, asking, “How much money do you have in a savings account?” They found that 21% do not have a savings account and another 28% have a savings account but their balance is zero; that is a total of 49% without savings. People contribute to their 401(k), but fail to regularly contribute to normal savings. Only a tiny 14% of respondents had more than $10,000 in savings, a sign of financial stability.

The IRS reports similar results for retirement plans, only 8% of Americans invest retirement money outside of employer 401(k) plans. Since 2008, rising regulation has prompted many companies to drop their 401(k) plans for employees, so that only half of American workers even have access to an employer-sponsored retirement plan. When on their own, the average American does not consistently set aside money for savings, let alone retirement outside of a 401(k).

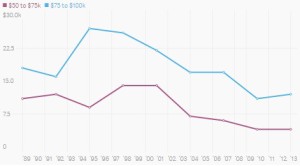

The graphic is a chart of Financial Assets, excluding retirement accounts. It reveals that even before the 2008 recession that savings have been falling since the 1990’s, even for people with a high income, those earning $75,000 to $100,000. These above-average income earners only have $12,500 in savings, a very small amount for potential emergencies such as job loss, home or car repairs, etc.

An unexpected repair, car replacement, or medical bill that is funded with debt instead of savings will unnecessarily consume your income and net worth. Please do not follow the masses with tiny savings and retirement accounts. A small emergency can start a cascade of financial difficulty for those without a savings cushion.