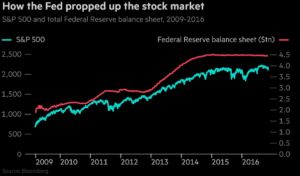

It has been nearly 10 years since the global financial crisis was caused by skyrocketing defaults on mortgages. In the chart you can see the U.S. Federal Reserve’s response to the crisis: they stepped in and bought bad loans and bonds to provide liquidity that kept banks solvent. Their continued buying has expanded the balance sheet of the Federal Reserve by over $4 trillion dollars. This money has flowed into and created price bubbles in the stock, bond, and real estate markets.

The U.S. isn’t the only central bank propping up markets like this; the Bank of Japan, the Bank of England, and the European Union central bank is also buying bonds and stocks every month. The Swiss central bank is now among the largest owners of Apple and Tesla stock shares. It used to be called socialist nationalization when governments bought companies, but in today’s upside down world of Newspeak, it is now labeled “providing liquidity to the market.”

This month, the U.S. Federal Reserve is going to begin a reverse program of reducing their balance sheet by starting to sell bonds each month. The red line on the chart will begin a steady decline. Pulling money out of the economy must be a contracting force to the economy, and so the blue line of the stock market will likely decline along with it.

Are you positioned for a possible decline in asset bubbles, like the stock, bond, and real estate markets? Consider this your Early Warning Alert of a likely decline in the next few years.