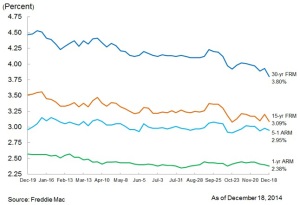

Mortgage rates have been trending down all year and are just under 4.00% today for a 30-year fixed mortgage. Many people missed the opportunity in January 2013 when rates dropped all the way down to 3.50% before they shot up to 4.50% a few months later.

Now is your chance to grab some cheap money before rates pop-up again. Rates are so low that some people can move from a 30-year term down to a 15 or 20-year term with a monthly payment that is the same or lower that their current payment.

Another consideration is if you have any debt with a rate higher than 4%. You may want to consider rolling this debt onto your mortgage to lower your interest expense.

Like any financial move, there are elements you need to consider:

- Will you spend your interest savings or use it to pay down principal each month?

- If your debts are moved to your mortgage, will you rack them back up again?

- Can you knock out small unsecured debts without adding them to your mortgage?

- By putting the new monthly savings toward reducing the principal loan balance, would you be increasing payoff length of your mortgage?

Managing any debt, no matter how small, requires discipline or it can ruin your credit rating and your net worth. Managing larger debts and a mortgage requires more diligence at budgeting and planning or you can potentially lose your home. If you do not have the psychology, budgeting, and discipline then there are painful lessons if you open credit cards, let alone car loans or mortgages. Contrarily, there are financial benefits for conservative use of loans:

- Credit card loyalty programs benefits

- Home ownership

- Income producing real estate

- Income producing business assets

- Access to emergency funds with credit

With interest rates at such low levels, now is a good time to examine all of your debts and determine if you may be financially better off by refinancing them today.