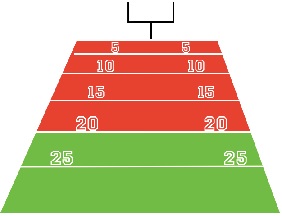

At age 50 you are in the fourth quarter of your earning career and too many at this age have no notable retirement savings. This is a red-alert financial emergency situation. According to Owen Murray, Director of Investments at Horizon Advisors, “Building a nest egg is like losing weight, there are no shortcuts. People have to spend less and save more.” The likely obstacle to beginning or saving more is probably a mental one.

At age 50 you are in the fourth quarter of your earning career and too many at this age have no notable retirement savings. This is a red-alert financial emergency situation. According to Owen Murray, Director of Investments at Horizon Advisors, “Building a nest egg is like losing weight, there are no shortcuts. People have to spend less and save more.” The likely obstacle to beginning or saving more is probably a mental one.

Peak earning years are around age 45-54, and after age 50, you’ll be lucky if you have 15 years remaining to save (health and age can limit career options over age 60). With zero in savings, some at age 50 would need to save nearly 60% of their income to comfortably retire at the typical age of 65.

Let’s look at some retirement math. In order to withdraw $18,000 a year from your retirement account for the rest of your life, at that point you’ll likely need a balance 25 times that amount, or $450,000. That is a lot to accrue in just 15 years, a savings rate of $30,000 per year. The average person making $55,000 a year will likely have difficulty achieving this. But, however difficult it may be, the alternative is far worse – retiring without adequate savings.

What do you do in an emergency? Drop everything and focus on the problem. In this case, it may mean drastically downsizing and making severe cutbacks in your lifestyle to create the savings necessary to retire. If you’re unwilling to take these drastic measures – exactly how well do you think you’ll handle the downsizing in retirement with only social security as your income, after Medicare and medical deductions? Have you looked up how much your social security income is estimated to be and by what age?

There are a few critical financial tasks for a successful retirement:

- All debts are extinguished. This means no student loans, mortgages, or credit card balances.

- You have mapped out how much money you’ll need. This is covered by social security, any pension, plus a sustainable withdrawal rate of your retirement assets. A sustainable rate starting point is 4% of the account balance per year.

- Expected medical expenses are covered. Paying for prescriptions and medical care is becoming more expensive and will take a larger and larger share of your income.

So if you are nearing age 50 with little to no retirement savings, now is the time to get into emergency mode and do something about it – as if your hair were on fire.